Full Length Research Article - (2023) Volume 18, Issue 4

Financial Flexibility And Its Impact On Achieving Financial Recovery, Study For A Sample Of Iraqi Commercial Banks

Tahseen Jumaah Dawood1* and Faten Zoghlami Shili2*Correspondence: Tahseen Jumaah Dawood, University of Sousse, Tunisia, Graduate School of Business in Sousse, Tunisia, Email:

Abstract

Purpose: The aim of the current study is to identify the impact of financial flexibility in achieving financial recovery, through the use and employment of indicators of financial flexibility in achieving financial recovery for commercial banks listed in the Iraq Stock Exchange.

Theoretical framework: Financial flexibility is seen as multiple patterns that reflect the work of the characteristics and rules of each job, but it crystallizes around a specific topic, which is the ability of financial institutions to respond to environmental changes and fluctuations through their ability to take actions and decisions that direct and restore the functions of institutions and resources in a manner consistent with the development of goals and strategic vision of the management, thus achieving financial recovery and achieving an increase in the economic activity of the financial institution during the period of time through an increase in the value of assets.

Design and methodology: Multiple linear regression and statistical program (SPSS 26) were relied upon by analyzing the relationship between financial flexibility and financial recovery of Iraqi commercial banks during the fiscal period (2009-2020).

Results: The results showed that there is a statistically significant effect of indicators of financial flexibility on indicators of financial recovery of Iraqi commercial banks. Recommendations: The need for commercial banks to utilize a culture and philosophy of financial flexibility, because of its effective role in facing banking risks and achieving financial recovery for them, as this culture makes commercial banks able to confront them with financial crises.

Keywords

Financial flexibility. Equity multiplier. Debt to equity. Financial recovery. Rate of return on assets. Rate of return on deposits

Introduction

The changes witnessed in the past three decades led to the need for financial institutions to be flexible in all their administrative and financial systems, and since the world is witnessing rapid and remarkable progress in the field of management, money, and business, which led to the formation of an environment with a turbulent impression; therefore, financial institutions that do not wish to be an institution with financial and administrative fragility, it must be an institution with a capital and organizational structure that have high financial flexibility, (Estwic, 2016). Therefore, financial flexibility is the pillar and the important axis for the survival and continuity of financial institutions that ensure that they are not exposed to financial hardship in the near future, in addition to the fact that financial flexibility is the protective wall against the occurrence of financial fragility by avoiding what is known as financial hardship (Sasho & Aleksandar, 2016). The study (Hohenstatt, Steininger, & Christian, 2011) considers that financial flexibility is the ability of the institution to restructure its capital, by avoiding financial hardship in facing crises, and the institutions that have financial flexibility enable to face financial stumbles, as well as financing investment if opportunities are available for professionals. While the study (Liu, 2014) indicated that financial flexibility is the ability of the financial and banking institution to provide financial resources to obtain an appropriate reaction in unexpected cases and events to maximize the value of the bank and achieve recovery.

Also, the evolution of the approach taken to achieve financial recovery and stability of the financial system over the years has formed a point of interest in terms of the partial prudential dimensions to the macro-precautionary dimensions of financial stability, meaning that the development in the analysis of early warning indicators to monitor the state of the banking system can be represented through the analysis of indicators of financial flexibility and recovery financial through the most important indicators of financial stability. In addition to the increased focus on a broader system-wide assessment of the risks to financial markets, institutions, and infrastructure in recent times, the analysis of financial indicators and a greater focus on behavior dynamics and the potential accumulation of unstable conditions represent one of the main issues behind these analytical developments and the need to bridge the data gaps in many fields (Al-Ali, 2016). The study (FDIC, 2010) indicates that financial recovery is the time through which it is possible to reduce expenses and increase income, thus eliminating indebtedness, as well as liberation from the financial crisis and return to a stable financial situation. While (Bank of Algeria, 2004) defined financial recovery as the process that provides all the information that contributes to improving the financial infrastructure in order to achieve recovery for economic institutions and provide their vital services in case they are exposed to financial threats that hinder their work. (FSB, 2012) explained that financial recovery is the time that allows the financial institution to fully restore financial strength and improve its ability to survive in the event of severe financial pressures.

The actual application involves indicators of financial flexibility through its suitability with the nature of banking work and facing the financial risks that banks are exposed to in their work, in addition to achieving financial recovery because of addressing financial management of these risks which are considered a great burden on banks. Furthermore, financial institutions must be characterized by a sufficient degree of financial recovery to avoid exposure to possible financial hardship. Therefore, the problem of the study can be formulated through the main following question:

-Is there a statistically significant effect between financial flexibility and financial recovery for the study sample?

And the study problem divides into the following questions:

-Is there a statistically significant effect between the equity multiplier index and the indicators of financial recovery, in the study sample?

-Is there a statistically significant effect between the debt ratio index and the financial recovery indicators of the study sample?

The main objective of the study comes through identifying the causal relationship between the study sample variables represented by financial flexibility and financial recovery, thus the study sought to achieve intellectual and theoretical framing of the study literature and its variables represented by financial flexibility and financial recovery and identify and track its intellectual paths for the purpose of consolidating concepts, as well as describing and identifying sources and the explanatory axes of the variables and indicators of the study.

Previous studies

Previous studies are among the important concepts on which the current studies are based, through their important role in supporting and understanding the current study and its variables. As well as establishing and strengthening the theoretical part, defining the problem of the study, identifying its dimensions, and expanding on new ideas to get benefits and formulate a new model commensurate with our current study.

• The author of the study (Bartram, 2017) showed that real investment by non-financial firms is systematically related to the size of their defined benefit plan. In particular, the most important findings of the study are that financial flexibility has a positive correlation with research and development that would generate growth options or that it negatively affects growth options.

• A study (Wara, 2015) indicated the possibility of dividend payments as part of an integrated financial strategy for companies, which includes future financing needs, and has costs and advantages over financial flexibility because it includes the amounts and timing of cash flows. The study reached several results, the most prominent one was the existence of a relationship between financial flexibility and the dividend profits policy, and that the probability and number of profits decrease with the increase in the value of financial flexibility. While the recommendations included the need for trainers and academics to develop a suitable method for the relationship between the profit distribution policy and financial flexibility, as well as searching to develop a mechanism for the growth of capital markets.

• The study (Meibergen, 2015) included the field of financial mathematics and focused specifically on credit risk. The study also looked at historical statistics and modeled them in the framework of pricing. The study also assumed that there is a relationship between recovery and default, and the default risks depend mainly on stock prices and the low models assume the occurrence of default errors that often occur externally, by relying on the implied recovery on the corresponding share price that has already been modeled by decision tree. The study reached a set of results, the most important of which was that the relationship between the possibility of default in the stock price is a common problem.

• The study (Aizenman & Pasricha, 2012) showed that the emergence of internal financial pressures in countries with developing economies and the volume of decline in stock price indices was similar to the cases that occur in high-income countries, indicating that there is no separation between them. Therefore, it seeks to reduce indebtedness to control capital flows during the current crisis that afflicted countries and the study indicated that distress during the financial crisis, whether external or internal, is closely correlated to the strength of the financial recovery. The study also reached several results, the most important of which was the existence of a correlation in the level of the rise in the international reserve with the level of decline in capital flows, in addition to achieving financial recovery through the improvement in stock prices in the banking sector.

• The study (Ross, 2015) believes that predicting distributions in stock returns accurately can be achieved if they do not conflict with external estimates, and it can be noted that options prices tend to be priced according to approved government prices and the state in which the country is. This makes the financial companies and investors in a state of hesitation in dealing with these markets because of their distance from the risks. The results of the study also represented the possibility of using the future distribution in the financial markets for returns as much as the use of forward interest rates as future expectations of interest rates. In addition, the owners of financial institutions use historical estimation in the financial markets as input to the asset allocation models. The most important recommendation was represented in the possibility of applying options to achieve recovery in financial markets in an expanded manner, such as forward contracts, currency, and fixed income, except for forward interest rates.

Experimental Methodology

Data description and preliminary analysis

The study aims to determine the impact of financial flexibility in achieving financial recovery for the five commercial banks listed on the Iraq Stock Exchange during the financial period (2009-2020).

Description data

The sample of the study was the commercial banks listed within the Iraq Stock Exchange, which are five banks, during the financial period (2009-2020). More clarification of these banks can be made through table 1 below (Table 1):

| Seq. | Bank’s Name | Founded Year | Bank Code | The capital of the bank upon incorporation | The Listing Date in The Market |

|---|---|---|---|---|---|

| 1 | Baghdad Bank | 1992 | BBOB | 100,000,000 | 2004 |

| 2 | Assyria Bank | 2005 | BASH | 25,000,000 | 2007 |

| 3 | Commercial Bank | 1992 | BCOI | 150,000,000 | 2004 |

| 4 | Gulf Bank | 1999 | BGUC | 600,000,000 | 2004 |

| 5 | Middle East Bank | 1993 | BIME | 400,000,000 | 2004 |

| Source: The Annual Report of the Iraq Stock Exchange | |||||

The current study indicated that the Iraqi commercial banks listed within the Iraq Stock Exchange are among the effective institutions in consolidating and stabilizing the country's economy, as well as achieving growth through increasing investment in banks by developing and providing banking awareness and educating customers to deposit their money with commercial banks and not to resort to hoarding.

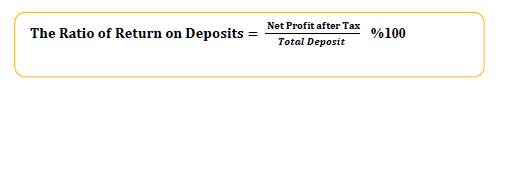

To achieve the study objective, the researchers used two variables for the study, the first represented by financial flexibility and its indicators (multiplier of property rights, debt to equity), while the second variable was represented by financial recovery and its indicators (return on assets, return on deposits).

Measure the study variables

Measuring indicators of financial flexibility

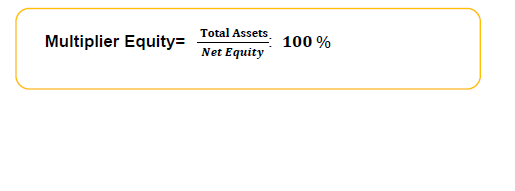

Multiplier equity

This measure is considered one of the indicators that measure and support the contribution of equity in financing the assets of financial institutions, as the equity multiplier reflects the financial leverage, financing policy, and any source that represents financing for the institution, whether it is equity or money for others (Saunders & Cornett, 2012). It is calculated according to the following equation:

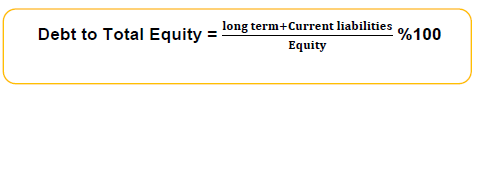

Debt to total equity

The debt-to-equity ratio is used to measure the financial leverage of financial institutions, which explains the amount used by institutions to finance the assets they need as much as the value represented by equity (Reilly, 2016) and can be calculated according to the following equation:

Measuring indicators of financial recovery

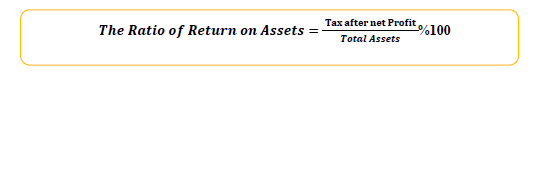

The ratio of return on assets:

This ratio works to measure the net profit in commercial banks that the shareholders get through investing their money, which depends mainly on the returns that are achieved from the assets, which is also called the “return on investment” because it is considered one of the important measures for measuring the profitability of long and short-term investments in banks (Gitman, 2009) and the return rate is expressed by the following equation:

Measuring indicators of financial recovery

The ratio of return on assets:

This ratio works to measure the net profit in commercial banks that the shareholders get through investing their money, which depends mainly on the returns that are achieved from the assets, which is also called the “return on investment” because it is considered one of the important measures for measuring the profitability of long and short-term investments in banks (Gitman, 2009) and the return rate is expressed by the following equation:

Preliminary analysis of the study indicators

The variables of the current study were represented by two variables: financial flexibility and financial recovery. The study came to measure the impact of financial flexibility on financial recovery and to identify the most important results during the period of the study (Table 2).

| Variants | Average | Max | Min | s.d |

|---|---|---|---|---|

| AOR | 3.77 | 15.98 | 2.22 | 4.44 |

| DOE | 17.89 | 84.47 | 7.33 | 24.18 |

| ROA | 7.46 | 47.03 | 0.77 | 13.29 |

| ROD | 1.98 | 11.50 | 0.81 | 3.04 |

| Source: prepared by the researcher based on the study indicators | ||||

Table (2) shows the readable percentages of the study indicators during the period, as the results were represented by the weighted average of the indicators of the research sample, which were 17.89, 3.77, and 7.46, respectively, as the property right index on total loans had the highest percentage, which was 17.89. While the highest percentages were represented by the results of the indicators of the study sample, which were 84.47, 47.03, and 15.98, respectively. The property right index on total loans obtained the highest percentage among the percentages, which was 84.47. The financial results also showed the lowest percentages for the study variables, which were 7.33, 2.22, and 0.81, respectively. The property right index on total loans obtained the highest percentage, which was 7.33, while the results of the standard deviation for the period for the study sample were 24.18, 13.295, and 4.44, respectively.

Experimental Model and Hypothesis

The simple and multiple linear regression models are among the best mathematical models that fit the hypotheses of the study, as the regression function tries to estimate the average of the dependent variable provided by the independent variables, and thus to estimate the linear relationship between the independent variable and the dependent variable.

The first model: the effect of property rights on financial recovery

PC= β0 + β1D + E ……… (1)

The second model: the effect of debt ratio to total equity on financial recovery

D= β0 + β1D + E …….. (2)

Where: PC-Equity Multiplier; β0-Return on Assets; D-Debt to Total Equity; β1DReturn on Deposits; E-Random Error limit

Application and statistical analysis

In this section, the statistical analysis of the study will be dealt with, and it includes testing the hypothesis involving whether the hypothesis is accepted or not, as the statistical analysis program (SPSS 26) will be used in the process of analysis and verification of hypotheses.

The impact of the equity multiplier index on the financial recovery index: (Table 3)

| Bank Name | Y1 | Y2 | ||

|---|---|---|---|---|

| R | R2 | Sig | R | |

| Baghdad Bank | 0.56 | 0.31 | 0.00 | 0.95 |

| Assyria Bank | 0.22 | 0.05 | 0.04 | 0.12 |

| Commercial Bank | 0.37 | 0.13 | 0. 03 | 0.43 |

| Gulf Bank | 0.3 | 0.09 | 0. 02 | 0.26 |

| Middle East Bank | 0.29 | 0.01 | 0.04 | 0.01 |

| Source: Prepared by the researcher based on the results of the statistical analysis | ||||

The results shown in Table (3) show the following:

Indicator (Y1) results:

• The highest value of the determination coefficient (R2) was (0.31) for the Bank of Baghdad, which means that the independent variable (ownership right) explains 31% of the change in the dependent variable (Y1), while the remaining percentage (69%) is due to other variables that were not included in this model. Furthermore, the correlation strength (R) was (0.56), and this means that the correlation between the independent and dependent variables is an average direct correlation.

• The highest value of significance (sig) was (0.04), which is smaller than the level of significance (0.05) for the Bank of Baghdad, and this is evidence of a statistically significant relationship between the independent variable (ownership right) and the dependent variable (Y1). As for the rest of the banks, it was smaller than the level of significance (0.05). It is concluded that ownership right has a significant effect on the recovery during the study period (2009-2020), and this confirms the acceptance of the alternative hypothesis (H1) “There is a statistically significant effect of the owned capital indicator on the financial recovery indicator” and the hypothesis was rejected major zero (H0) during the period under study.

Indicator (Y2) results:

• The highest value of the determination coefficient (R2) was (0.91) for the Bank of Baghdad. This means that the independent variable (ownership right) explains 91% of the change in the dependent variable (Y2), while the remaining percentage (9%) is due to other variables that were not included. In this model, to explain this change, the correlation strength (R) was at a value of (0.95), which means that the correlation between the independent and dependent variables is a strong direct correlation.

• The highest value of significance (sig) was (0.04), which is smaller than the level of significance (0.05) for the Bank of Baghdad, and this is evidence of a statistically significant relationship between the independent variable (right of ownership) and the dependent variable (Y2). As for the rest of the banks, it was less than the level of significance (0.05. We conclude that (equity right) has a significant effect on recovery during the study period (2009- 2020), and this confirms the acceptance of the alternative hypothesis (H1) “There is a statistically significant effect of the equity index on the financial recovery index” and the rejection of the main null hypothesis (H0) during the researched period.

The effect of debt ratio to total equity on financial recovery (Table 4)

Bank Name |

Y1 | Y2 | ||

|---|---|---|---|---|

| R | R2 | Sig | R | |

| Baghdad Bank | 0.08 | 0.00 | 0.04 | 0.02 |

| Assyria Bank | 0.15 | 0.02 | 0.03 | 0.13 |

| Commercial Bank | 0.26 | 0.06 | 0.04 | 0.04 |

| Gulf Bank | 0.06 | 0.00 | 0.03 | 0.15 |

| Middle East Bank | 0.34 | 0.12 | 0.02 | 0.31 |

| Source: Prepared by the researcher based on the results of the statistical analysis | ||||

Following conclusions may be derived from the results shown in table (4):

Indicator (Y1) results:

• The highest value of the determination coefficient (R2) was (0.12) for the Middle East Bank, which means that the independent variable (debt ratio to total equity) explains 12% of the change in the dependent variable (Y1), while the remaining percentage is (88%) it goes back to other variables that were not included in this model. The correlation strength (R) was worth (0.34), and this means that the correlation between the independent and dependent variables is a direct average correlation.

• The highest value of significance (sig) was (0.04), which is smaller than the level of significance (0.05) for the Middle East Bank. This is evidence of a statistically significant relationship between the independent variable (debt ratio to total equity) and the dependent variable (Y1). We conclude that (The debt-to-equity ratio) has a significant impact on financial recovery during the study period (2009-2020), and this confirms the rejection of the alternative hypothesis (H0) and the acceptance of the main null hypothesis (H1), which states that “There is a statistically significant effect of the debt-to-debt ratio indicator total property rights on the financial recovery index” during the research period.

Indicator (Y2) results:

• The highest value of the coefficient of determination (R2) was (0.16) for the commercial bank, and this means that the independent variable (debt ratio to total equity) explains 16% of the change in the dependent variable (Y2), while the remaining percentage (84%) belongs to other variables that were not included in this model. The correlation strength (R) was at a value of (0.40), and this means that the correlation between the independent and dependent variables is an average direct correlation.

• The highest value of significance (sig) was (0.04), which is smaller than the level of significance (0.05) for the Ashur Bank. This is evidence of a statistically significant relationship between the independent variable (debt ratio to total equity) and the dependent variable (Y2). We conclude that (the ratio of Debt to total equity) has a significant effect on financial recovery during the study period (2009-2020), and this confirms the rejection of the alternative hypothesis (H0) and the acceptance of the main null hypothesis (H1), which states that “There is a statistically significant effect of the indicator of the ratio of debt to total equity on the financial recovery index” during the research period.

Conclusion

The main purpose of conducting this study is to identify and determine the impact of financial flexibility in achieving financial recovery for commercial banks, the study sample, which is listed in the Iraq Stock Exchange, as the researcher tried to address the problem and answer the questions raised in the research, and the research was divided into several aspects, and we will discuss the most prominent of them:

Conducting a systematic study represented by reviewing the most important summaries of the study, and then identifying some previous studies related to financial flexibility and financial recovery, as well as the theoretical aspect by identifying the concepts of financial flexibility and financial recovery accurately.

The indicators and measures used for the study were also identified, and then the analysis of the study indicators was discussed, after which an applied and practical study was conducted, which is considered one of the main aspects on which the research is based, using a set of statistical methods to choose the hypothesis represented by descriptive statistics and in-depth statistics.

The study reached several results that can be used by the rest of the commercial banks, whether Iraqi, Arab, or foreign. The study showed that there is a statistically significant correlation between the indicators of financial flexibility and the financial recovery of the study sample, in addition to that all the banks in the study sample utilize financial stability, due to the strength of their financial structure and their utilization of financial flexibility and financial recovery that allows to address banking risks and enable to achieve recovery financially.

It is also possible to identify the most prominent recommendations of the study, which stipulate the need for commercial banks to have a culture of financial flexibility, because of the effective role of flexibility in facing banking risks and achieving financial recovery, as this financial culture could develop banks and address the financial crises in the future. As well as the possibility of Iraqi banks maintaining sufficient funds to avoid financial obligations in the event of sudden withdrawals of deposits by depositors.

In conclusion, the researcher indicates the possibility of conducting some other studies for other banks with more time periods in order to give an expansion with the rest of the indicators of flexibility and financial recovery. As well as using the results reached in the study in order to develop a future that enables them not to fall into future financial crises.

References

Aizenman, J., & Pasricha, K. (2012). Determinants of Financial Stress and Recovery during the Great Recession. International Journal of Finance and Economics, 347-372.

Al-Ali, A. (2016). The possibility of achieving financial recovery using the theory of real options in Taksim investment projects. PhD thesis in Business Administration, College of Administration and Economics, University of Kufa.

Bank of Algeria. (2004). Economic and Monetary Development in Algeria. Algeria: Algeria: Bank of Algeria, IMF Country Report No. 04/13.

Bartram, M. S. (2017). Corporate Financial Flexibility and Real Investment. Management Science, 355–383.

Estwic, S. (2016). Principal-Principal Agency and Financial Flexibility in Transition Economies. Business Inquiry, 33-54.

FDIC. (2010). Financial Recovery. Financial Education Curriculum,report, participant Guide.

FSB. (2012). Recovery and Resolution Planning: Making the Key Attributes Requirements Operation. Financial Stability Board,Report, consultative document.

Gitman, L. (2009). Principles of Managerial Finance. 12th Ed Person.

Hussein, A. A., & Zoghlami, F. (2023). The Role of Engineering Insurance in Completing Projects by Using Bank Loans: An Applied Study in a Sample of Iraqi Insurance Companies and Banks. International Journal of Professional Business Review, 8(1), e0926. https://doi.org/10.26668/businessreview/2023.v8i1.926.

Hohenstatt, R., Steininger, B., & Christian, S. (2011). Cross sectional variance in financial Flexibility: Evidence from American REITs and REOCs. Thesis, University of Regensburg.

Liu, M. (2014). Research on Enterprise Financial Flexibility. Thesis, Chengdu: Southwestern University of Finance and Economics.

Meibergen , N. (2015). Continuous Term Structures for Implied Recovery. thesis, Delft University of Technology.

Mousawi, S. (2013). The dynamics of capital structure according to the philosophy of capture theory and its reflection on strategic financial performance. Ph.D. thesis in Business Administration, College of Business and Economics, University Al-Mustansiriya.

Reilly, P. (2016). Flexibility at Work: Balancing the Interests of Employer and Employee. European Business Review.

Ross, S. (2015). The Recovery Theorem. by American Finance Association, The Journal of Finance.

Sasho, A., & Aleksandar, N. (2016). Determinants of capital structure: An empirical study of companies from selected post-transition economies. Preliminary communication, 119-146.

Saunders, A., & Cornett, M. (2012). Financial Markets and Institutions. 5th edition, McGraw-Hill/Irwin.

Wara, R. (2015). The Relationship between Financial Flexibility and Dividend Payouts: A Case of Listed Firms in Kenya. European Journal of Business and Management, 51-58.