Full Length Research Article - (2023) Volume 18, Issue 5

The Impact of International Capital Budgeting Criteria on Investment Decisions: A Guide from Foreign Companies Investing in the Iraqi Environment

Alaa Mohsen Shham* and Dr. Abdelfettah Bouri*Correspondence: Alaa Mohsen Shham, Faculty of Economic Sciences and Management, University of Sfax, Tunisia, Email:

Received: 06-Oct-2023 Published: 20-Oct-2023

Abstract

This study aims to investigate the feasibility of establishing international capital budgeting Criteria (ICBC) that are more suitable for international companies in making investment decisions (ID). It highlights the equations related to measuring the results of international capital budgeting (CB) Criteria that contribute to achieving and predicting future cash flows. The research sample consisted of analysts, investors, academics, financial managers, and individuals interested in foreign investments and financial data analysis across various service contract fields. The researcher distributed 343 valid survey forms for analysis. The questionnaire included a set of paragraphs and questions, and the data were collected and categorized using the statistical software (SPSS 24). The study concludes that ICBC based on discounted cash flows (DCF) are preferred measures for making optimal ID in the Iraqi environment.

Keywords

Capital budgeting. Investment decisions. International criteria

Introduction

Investment decisions represent a critical aspect for international companies, relying on International Capital Budgeting CB Criteria. In today's business world, the success of international investment hinges on two fundamental elements: International CB and prudent ID, integral components of the strategic planning for international companies venturing beyond their national borders (Nehme et al., 2023). This involves assessing returns, costs, and various risks associated with investments in a specific country. The preparation of international capital budgets plays a crucial role in senior management's decision-making, providing a basis for comparing alternative international project investment options. By utilizing CB Criteria effectively, distinctions can be made between international projects worthy of investment and those that are not. International CBis particularly significant as it directly impacts the company's value. Investment is a venture aimed at maximizing the company's value, determining its size, speed, and direction of growth (Alyaseri et al., 2023; Jawad et al., 2023). It serves as a means to uncover risks related to ID and is a significant challenge requiring thorough investigation and research for relevant information. This study contributes to the ongoing research in assessing the feasibility of relying on ICBC for companies and the resulting impact on ID. It aims to contribute to achieving competitive advantage, sustainability, and maximizing shareholder wealth by realizing corporate goals (Alwan et al., 2023; Salman et al., 2023). To highlight the reflections related to ID and the importance of relying on ICBC as a tool to enhance the effectiveness and efficiency of ID, despite the substantial support and high appropriateness achieved by these Criteria, their preparation and implementation face numerous scientific, practical, political, social, and environmental challenges and difficulties. These challenges include achieving cash flow estimates, discount rates, and the influence of political, social, and environmental factors on ID. Therefore, the primary research problem arises: What is the impact of ICBC on ID? Based on the above, the main research objective is to elucidate the role of ICBC in making optimal ID for international projects.

Literature review

Capital budgeting

CB refers to the process used by executives to make decisions about whether long-term investments or capital expenditures are worth pursuing for their companies (Baker & English, 2011; Flayyih & Khiari, 2023). In other words, CB is a quantitative and sequential financial plan for future investment activities, serving as a planning and control tool for financial management. Mansour (2018: 191) emphasizes that CB involves a set of quantitative and financial expressions for a specific program that the company seeks to implement, associated with the investment activities through its inclusion in the investment budget plan, allowing for planning and monitoring these activities. Previous studies emphasize the importance of examining the concept of CB over the decades, offering alternative investment evaluation methods ranging from simple to complex approaches with mutual strengths and weaknesses (Saidu, 2014). The literature encourages reinforcing the CB guide and post-investment auditing to enhance the techniques of complex investment decision-making (Priaga & Daryanto, 2020: 84). Similarly, Priaga & Daryanto (2020) define CB as an analysis and selection process for long-term asset investment opportunities, serving as a tool for planning, control, and resource allocation. Concerning the definition of CB, Mansour (2018) points out that it is a plan for capital expenditure on fixed assets, prepared by financial administrators based on project analysis to make necessary decisions about including certain projects in the pre-prepared plan. Lastly, our study provides a definition of CB as a process of creating, formulating, evaluating, and indexing the risks of investment projects expected to generate long-term revenues at a rate of return exceeding the cost of the capital used (Prodanov, 2012: 10). In conclusion, there is consensus on the importance of CB as a vital tool for making ID and achieving company goals. However, the study also reveals challenges that varied in the preparation and execution processes between international and local CB.

International capital budgeting

Numerous researchers have conducted studies in advanced countries, offering an international perspective on CB practices. Researchers have pointed out that international CB decisions face a diverse set of challenges rarely encountered by local companies in CB preparation. This is because international companies must deal with issues related to exchange rate risks, resource risks, frozen funds, foreign tax regulations, political risks, and differences in the fundamental business risks between foreign and local projects (Khan & Jain, 2011: 1299). Despite the complexities of international investments, there is a growing trend of establishing subsidiaries by multinational corporations, as well as direct foreign investments by international companies in other countries (Khan & Jain, 2011: 1300). There is a need to distinguish between the basic cash flow and the cash flow for projects, allowing multinational companies to assess the cash flow associated with projects in two ways: one may consider the net impact of the project on their fixed cash flow (Maseer et al., 2022). The other may treat the cash flow independently or non-uniformly. The theoretical perspective emphasizes evaluating the project from the perspective of the parent company, where dividend distributions and debt repayments are handled by the parent company (Abdullah & Bin Mansor, 2018; Rashem & Abdullah, 2018). This supports the idea that the evaluation is related to the contributions the project can make to the result of the international company (Wankel, 2009). Moreover, international companies often need to allocate significant amounts of resources to external projects, anticipating costs and benefits over a long period . These projects, known as capital investments, include examples such as purchasing new equipment and expanding into foreign areas either through new investments or the acquisition of existing operations. CB, defined as the process of identifying, evaluating, and selecting projects that require substantial financial commitments, is often crucial for sound capital investments. From an interpretative perspective, CB can be seen as a process of constructing reality more than a rational choice, or "manufacturing" rationality. This is associated with cultural definitions of the correct approach to dealing with social dilemmas and is also influenced by ideological settings in the entire process of preparing international CB. International companies can be considered as a tool for transferring financial biases and thus "capitalism," focusing on a unique financial aspect in investment decision-making (Schonbohm & Zahn, 2016: 169). In summary, international CB is a concept related to capital and investment management in international assets and projects. It aims to achieve maximum company value in the long term, used by large companies operating globally or having international investment operations. The following are key points to understand international CB:

• Economic and Political Analysis: The impact of economic and political factors in the target countries on the sustainability and success of investment projects must be assessed.

• Evaluation of International Investments: International CB includes estimating investments in international projects. The company must assess the expected risks and returns for these investments and carefully analyze them.

• Financial and Economic Impact Assessment: The company must also estimate how international investments will impact its financial and economic performance. Will they contribute to increased revenues and profits? Will they expand the company and enhance its competitiveness locally and internationally?

• Identification of Financing Sources: The company must determine how to finance these international investments. Should it rely on internal funding or borrow? The cost of financing and appropriate financial policies must also be estimated.

• Compliance with International Laws and Regulations: International projects and investments must comply with the laws and regulations in the countries where the company operates. International compliance is an essential part of international CB.

• Management of International Risks: The company must effectively assess and manage international risks, including political and economic risks, fluctuations in foreign exchange rates, and market fluctuations that may affect its international projects.

International capital budgeting criteria

Payback period criterion

Decisions are often made based on the speed of investment recovery. The payback period (PP) is simply measured by the time required for cash flows from the project to recover the initial investment and is chosen with a preference for shorter and faster PPs (LLCSI, 6) Historically, studies have conducted numerous surveys on the PP criterion. The primary conclusion drawn from these studies is that companies use the PP criterion due to a lack of familiarity with more advanced Criteria (Al Ani, 2015: 471). Companies, especially for small projects, heavily rely on the less sophisticated PP criterion (Maroyi, 2011: 29). This criterion should be used as a primary tool when selecting investment projects (Disetia et al., 2022: 2). The PP criterion focuses on recovering the investment costs quickly due to the high level of operational risk in the business (Al Ani, 2015). The PP is said to highlight management's interest in liquidity and the need to reduce risk by quickly recovering the initial investment (Maroyi, 2011: 30). On the other hand, the criterion also emphasizes liquidity rather than profitability, even though the latter is more attractive to investors but can be achieved in the long term after the PP (Al Ani, 2015: 471). According to Sapkota (2010: 19), the PP is the traditional criterion for CB. It is the simplest and perhaps the most commonly used for evaluating ID. This technique is defined as the number of years it will take to recover the project's investment costs (Al Ani, 2015: 469). In other words, the PP measures the number of years for ID (Sapkota, 2010: 19). The PP criterion depends on the idea of the time the project needs to generate enough cash flows to recover the investment costs. The criterion is used to accept or reject projects if the PP is higher or lower than a predetermined number of years (Al Ani, 2015: 470). Although there are some problems in applying the PP criterion, there is wide acceptance of this technique by managers and investors. One problem with the PP technique is that it ignores cash flows beyond the PP in addition to the time value of money. Another is that the PP does not provide a realistic result. On the other hand, managers and investors usually do not consider other strategic variables in addition to the PP when evaluating CB decisions. In other words, the acceptance or rejection of CB decisions depends solely on the result of the PP criterion without considering other strategic variables that enhance investment decision-making (Al Ani, 2015: 469). The PP is the duration a company takes to recover its capital investment costs in a project. This time frame is essential when using this criterion for ID There are two ways to calculate the PP. The first method can be applied when cash flows are in the form of annual flows for each year of the project's life regularly. In such a case, the initial investment cost is divided by the regular annual cash flow: according to the following equation: (Sapkota, 2010: 20 Subedi, 2011: 25).

Payback Period= Annual Cash Flow/Initial Capital Investment

Accounting rate of return (ARR):

The (ARR) is another traditional criterion for evaluating capital investment projects, representing the profit from the investment as a percentage of the investment (Afework, 2016: 19). It relies on accounting information rather than cash flows (Subedi, 2011: 26; Sapkota, 2010: 21). The profit considered is the accounting profit, calculated as in the income statement, and can be calculated before or after tax. Typically, it is the average profit over the project's lifespan (Afework, 2016: 19). This criterion is also referred to as the Average ARR. It is defined as the average project income after deducting taxes and depreciation divided by the average book value of the investment over its life (Maroyi, 2011: 33). It is known as the Return on Investment (ROI), utilizing accounting information, as shown in financial statements, to measure the investment's profitability. It adheres to two fundamental principles: it is consistent with the "bigger and better" principle, giving equal weight to project profits in the first and last years (Adhikari, 2012: 34). The criterion uses net income and the book value of the investment instead of actual cash flows, derived from accounting records (Maroyi, 2011: 33). According to Davies and Boczko (2005), the ARR is a figure derived from information specific to a particular year, with no reference to other parts of the project. Additionally, it can be calculated using total profits instead of average profits, then dividing by the average investment. The management should continue using the criterion adopted since the project's inception (Maroyi, 2011: 33). Using the ARR criterion, a decision-maker can decide whether to accept or reject an investment proposal. According to the ARR criterion, as a acceptance-rejection criterion, the actual ARR is compared with a pre-determined rate or the minimum required rate of return (Sapkota, 2010: 22). The project is accepted if the ARR equals or exceeds the management's specified rate. The project is rejected if the ARR is less than the specified rate (Beyene et al., 2014: 26). The ARR criterion can be calculated using the following equations (Maroyi, 2011: 34):

Total ARR= 100 × (Average Annual Profit/ Initial Capital Investment)

Total ARR=100× (Initial Capital Investment/Average Annual Profit)

Average ARR= 100× (Average Annual Profit/Average Capital Investment)

Average ARR=100× (Average Capital Investment/Average Annual Profit)

We are believing that the scholarly sources indicate that the criterion relies on historical data and information from accounting records. Therefore, it is a valid criterion for the performance monitoring phase of ID based on ICBC. One of its significant drawbacks is its reliance on accounting profit rather than cash flows and its failure to consider the time value of money.

Concept and nature of ID

Popescu defines ID as involving the current commitment of funds with the expectation of future benefit flows (Garang, 2016: 3). A decision is enlightened when choosing the appropriate alternative from available options, also known as the process of selecting the best available alternative, after conducting a comprehensive study of the expected outcomes for each alternative and their impact on achieving the desired goals (Dosh & Fadhel, 2020: 3). Pandeg assumes that ID or analysis are related to the efficient allocation of capital. It involves a decision to commit company funds to long-term assets. Such decisions are crucial for the company as they tend to determine its value by influencing its growth rates, profitability, and risks (Kawugana, 2019: 132; Okanta, 2018: 182). Therefore, decision-making is a rational process or method of choosing one alternative from the available ones to achieve a specific goal (Dosh & Fadhel, 2020: 3). There are two types of investors in investment decision-making: rational investors and irrational investors. Rational investors make decisions based on logical thinking and information about the investment's probability. In contrast, irrational investors decide based on their psychological side, leading to bias in ID (Kartini & Nahda, 2021: 1233). In general, the following should be considered when making ID (Dosh & Fadhel, 2020: 3):

• The decision is made before it is termed the decision-making process, which forms a logical way to reach the optimal solution.

• Any position or general problem with alternative solutions must be identified, analyzed, and compared based on specific rules or measures.

• The method of discovering alternatives, determining selection rules, and choosing the optimal solution depends on a goal or set of goals that can be achieved, and the main criterion for measuring decision effectiveness.

The researcher views ID as the selection of the best positive alternatives to achieve the company's strategic goal, relying on the experience, knowledge, and high skills of decision-makers, in addition to the availability of information and continuous monitoring for implementation and monitoring of suitable and unsuitable outcomes to achieve the goal.

Criteria for CB and investment decision-making

The investment policy relies on globally recognized criteria for selecting projects, as resources are limited. ID concerning a specific project's opportunity or choosing among several options can be reliable when based on a system of complementary measures. The criteria used in investment evaluation must meet some basic requirements: ease of formulation, purpose alignment, and the ability to express the maximum possible based on a mathematical function (Mieila, 2017: 35). ICBC in assessing investments and making international ID involve a multidimensional activity. It encompasses initiating new investment projects, predicting benefits and costs, evaluation, licensing, and control. If this process is executed well, it undoubtedly maximizes the company's value. Investment projects inherently require a significant amount of capital and play a strategic role in the company's position in local and international markets. Therefore, investment managers must ensure that all investment projects follow the proper stages/steps in the investment process (Kipkirui and Kimungunyi, 2022: 242). In the context of the PP criterion, a study by Drury et al. examined the criteria used in ID in manufacturing companies in the United Kingdom and found that 63% of the companies use the PP criterion. The PP is also the most common criterion in the UK and Europe (Alsharif, 2016: 82- 83). A study by (Al-Mutairi et al., 2018: 5) explored the use of CB criteria in a sample of 140 non-financial Spanish companies. They found that the PP criterion is the most commonly used in CB. A study by (Gorshkov et al., 2016: 6) identified factors positively affecting the reduction of investment PPs as follows: a decrease in interest rates, inflation, and inflation risks. As for the ARR criterion, a study by (Banda et al., 2014: 77) investigated the use of CB Criteria in several large companies listed in Sri Lanka. The study revealed that most companies used only one evaluation method from their preferred criteria. The ARR criterion is not a preferred criterion for evaluating investment projects. Another study by (Oppong-Boakye and Addai, 2015: 213) focused on the use of CB criteria for companies in Ghana. The study aimed to verify the CB criteria used by companies in Ghana. The study revealed that nearly 63% of companies in Ghana use more than one criterion in CB analysis. Eighty-four percent of companies adopting multiple criteria for investment assessment. The study concluded that companies do not use the ARR criterion in evaluating investment projects. Based on the above, the main hypothesis is that there is a significant impact of international CB criteria on ID. From this main hypothesis, the following hypotheses can be derived:

1. There is a significant impact of the PP criterion on ID.

2. There is a significant impact of the ARR criterion on ID.

Methodology

A total of 343 valid survey forms were distributed for analysis. The questionnaire included a set of paragraphs and questions, and the collected data were organized and classified using the statistical software SPSS 24. The researcher employed two types of statistical analysis:

Descriptive statistics, encompassing frequencies, percentages, means, standard deviations, variance coefficients, and relative significance. Additionally, graphical representations were utilized to provide a clearer picture of the data and its characteristics. Analytical statistics, involving testing correlation relationships and impact relationships between research variables. Furthermore, the researcher utilized Cronbach's alpha coefficient to assess the reliability and stability of the survey questionnaire.

Results

Significance testing of correlations

Here, the researcher aims to identify and test the correlation relationships by determining the strength and significance of the relationship between the study variables. The results were generated and included in the following table 1 using the statistical software SPSS 24:

| Correlations | ID | |

|---|---|---|

| International CB | Pearson Correlation | .694** |

| Sig (2-tailed) | .000 | |

| N | 343 | |

| PP criterion | Pearson Correlation | .634** |

| Sig (2-tailed) | .000 | |

| N | 343 | |

| ARR criterion | Pearson Correlation | .482** |

| Sig (2-tailed) | .000 | |

| N | 343 | |

From the table above, it is evident that the correlation value between International CB and ID was 0.694. Given that the significance value (sig.) is 0, which is less than 5%, this indicates a statistically significant positive correlation below the 5% significance level. Similarly, the correlation value between PP and ID was 0.634, with a significance value (sig.) of 0, also less than 5%. Likewise, the correlation value between the ARR and ID was 0.482, and the significance value (sig.) was 0, less than 5%. Consequently, it can be inferred that higher values in International CB, PP, and ARR lead to better and more suitable results in ID.

Analysis of research variables

In this section, the hypotheses related to the impact analysis of independent variables on the dependent variable will be tested. The following null hypothesis (H0) is formulated for this purpose:

• Main Hypothesis (Testing the Impact of International CB on ID):

The null hypothesis to be tested is as follows:

H0: There is no statistically significant impact of International CB on ID.

H1: There is no statistically significant impact of International CB on ID.

• Against the alternative hypothesis:

H0: There is a statistically significant impact of International CB on ID.

H1: There is a statistically significant impact of International CB on ID.

A set of tables representing the results of the impact analysis has been extracted. The following table represents the values of correlation, determination coefficient, adjusted determination, and criterion error value:

The table 2 provides values for correlation, determination coefficient, adjusted determination, and criterion error. The table provides values for correlation, determination coefficient, adjusted determination, and standard error.

Model |

R | R Square | Adjusted R Square | Std. Error of the Estimate |

|---|---|---|---|---|

| 1 | .694a | .482 | .480 | .32214 |

| a. Predictors: (Constant), International CB | ||||

The table above indicates that the determination coefficient (R-squared) is 0.48, and the adjusted determination coefficient is also 0.48. This means that the regression model used, which includes the effect of international capital budgeting Criteria (ICBC) on ID, was able to explain 48% of the total variations. The remaining percentage is attributed to other variables and factors. Additionally, the researcher conducted an Analysis of Variance (ANOVA), as shown in Table (3):

| Model | Sum of Squares | Df | Mean Square | F | Say | |

|---|---|---|---|---|---|---|

| 1 | Regression | 32.888 | 1 | 32.888 | 316.926 | .000b |

| Residual | 35.386 | 341 | .104 | |||

| Total | 68.274 | 342 | ||||

| a. Dependent Variable: ID | ||||||

| b. Predictors: (Constant), International CB | ||||||

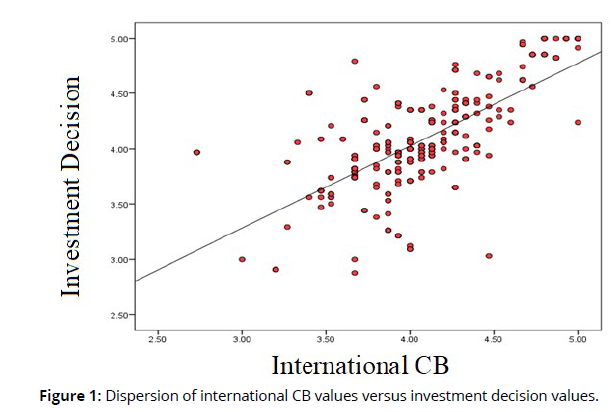

The table above clearly indicates the acceptance of the first alternative hypothesis (there is a statistically significant impact of international capital budgeting Criteria (ICBC) on ID). This implies that the preparation of international CB has a positive and statistically significant effect on ID at a significance level of 5%. This conclusion is drawn from the calculated t-value, which is 17.802, and the corresponding significance value (sig.) being equal to zero, which is less than the 5% significance level. Furthermore, the regression coefficient is equal to 0.69, suggesting that an increase in the value of international CB results in a 0.69 increase in the appropriateness and reliability of investment decision outcomes. The graphical representation (Figure 1) below illustrates the dispersion of values for international CB compared to the values of ID:

Second Hypothesis (Testing the Effect of PP Criterion on ID)

The null hypothesis to be tested here is as follows:

H0: There is no statistically significant impact of the PP criterion on ID.

H1: There is no statistically significant impact of the PP criterion on ID.

Against the alternative hypothesis:

H0: There is a statistically significant impact of the PP criterion on ID.

H1: There is a statistically significant impact of the PP criterion on ID.

A set of tables representing the results of the impact analysis has been extracted. The following table presents the correlation values, determination coefficients, adjusted determination coefficients, and the standard error (Table 4):

Model |

R | R Square | Adjusted R Square | Std. Error of the Estimate |

|---|---|---|---|---|

| 1 | .634a | .401 | .400 | .34621 |

| a. Predictors: (Constant), PP Criterion | ||||

The table above shows that the determination coefficient is 0.40, and the adjusted determination coefficient is also 0.40. This means that the regression model used, which includes the impact of the PP criterion on ID, was able to explain 40% of the total variations, while the remaining percentage is attributed to other variables and factors. Additionally, the researcher conducted an Analysis of Variance (ANOVA), as shown in the following Table 5:

| Model | Sum of Squares | Df | Mean Square | F | Say | |

|---|---|---|---|---|---|---|

| 1 | Regression | 27.401 | 1 | 27.401 | 228.597 | .000b |

| Residual | 40.874 | 341 | .120 | |||

| Total | 68.274 | 342 | ||||

| a. Dependent Variable: ID | ||||||

| b. Predictors: (Constant), PP Criterion | ||||||

The table above indicates that the regression model used is statistically significant at a 5% significance level. The test statistic F is 228.597, and the significance value (sig) is equal to zero, which is less than the 5% significance level. This suggests that the impact of the PP criterion on investment.

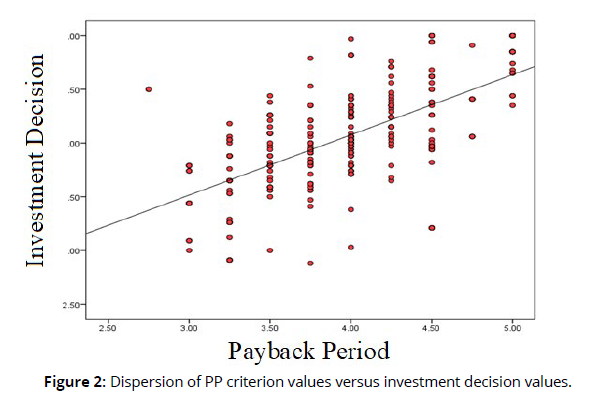

The table 6 above indicates the acceptance of the first alternative hypothesis (there is a statistically significant impact of the PP criterion on ID). This means that the PP criterion has a positive and statistically significant effect on ID at a significance level of 5%. This conclusion is drawn from the calculated t-value, which is 15.119, and the corresponding significance value (sig.) being equal to zero, which is less than the 5% significance level. Furthermore, the regression coefficient is equal to 0.63, suggesting that an increase in the value of the PP criterion results in a 0.63 increase in appropriateness and reliability of investment decision outcomes. The following graph illustrates the dispersion of values for the PP criterion compared to the values of ID (Figure 2):

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Say | ||

|---|---|---|---|---|---|---|

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 1.833 | .149 | 12.310 | .000 | |

| PP | .561 | .037 | .634 | 15.119 | .000 | |

| a. Dependent Variable: ID | ||||||

Third Hypothesis (Testing the Effect of ARR Criterion on ID)

The null hypothesis to be tested here is:

H0: There is no statistically significant impact of the ARR criterion on ID.

H1: There is no statistically significant impact of the ARR criterion on ID.

Against the alternative hypothesis:

H0: There is a statistically significant impact of the ARR criterion on ID.

H 1: There is a statistically significant impact of the ARR criterion on ID.

A set of tables representing the results of the impact analysis has been extracted. The following table presents the correlation values, determination coefficients, adjusted determination coefficients, and the standard error (Table 7):

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

|---|---|---|---|---|

| 1 | .482a | .232 | .230 | .39207 |

The table above indicates that the determination coefficient is 0.23, and the adjusted determination coefficient is also 0.23. This means that the regression model used, which includes the impact of the ARR criterion on ID, was able to explain 23% of the total variations. The remaining percentage is attributed to other variables and factors. Additionally, the researcher conducted an Analysis of Variance (ANOVA), as shown in the following table 8:

Model |

Sum of Squares | Df | Mean Square | F | Say | |

|---|---|---|---|---|---|---|

| 1 | Regression | 15.855 | 1 | 15.855 | 103.140 | .000b |

| Residual | 52.419 | 341 | .154 | |||

| Total | 68.274 | 342 | ||||

| a. Dependent Variable: ID | ||||||

| b. Predictors: (Constant), ARR | ||||||

The table above shows that the regression model used is statistically significant at a 5% significance level. The F-test value is 103.140, and the significance value (sig) is equal to zero, which is less than the 5% significance level. This suggests that the impact of the ARR criterion on ID is statistically significant. The following table includes the regression parameters (effect) for the ARR criterion in ID, along with their t-test values and significance (Table 9):

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Say. | ||

|---|---|---|---|---|---|---|

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 2.726 | .134 | 20.412 | .000 | |

| ARR | .345 | .034 | .482 | 10.156 | .000 | |

| a. Dependent Variable: ID | ||||||

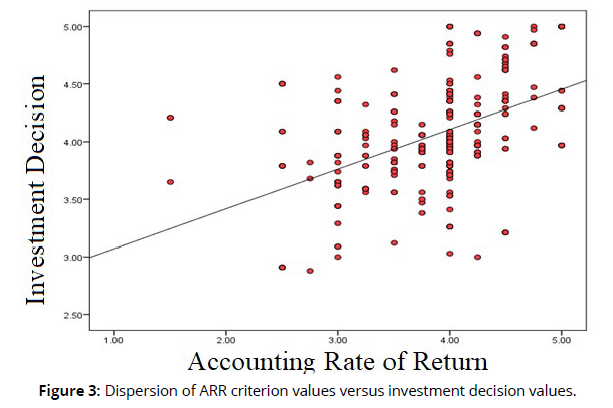

The table above indicates the acceptance of the first alternative hypothesis (there is a statistically significant impact of the ARR criterion on ID). This implies that the ARR criterion has a positive and statistically significant effect on ID at a significance level of 5%. This conclusion is drawn from the calculated t-value, which is 10.156, and the corresponding significance value (sig.) being equal to zero, which is less than the 5% significance level. Furthermore, the regression coefficient is equal to 0.48, suggesting that an increase in the value of the ARR criterion results in a 0.48 increase in appropriateness and reliability of investment decision outcomes. The following graph illustrates the dispersion of values for the ARR criterion compared to the values of ID (Figure 3):

Conclusion

The current study emphasizes the importance of accounting thinking in the development of ID by relying on CB Criteria, both theoretically and practically. It underscores the need to consider various variables and factors, studying and understanding their significance, and examining their impact on the results of CB Criteria and how they influence investment decision-making. The contemporary business environment imposes a necessity on companies to evolve their thoughts, philosophies, methods, and strategic orientations to keep up with developments and achieve competitive advantages and capabilities. The study reveals that a significant number of international companies focus their investments on oil projects, particularly in the Iraqi environment. The study also demonstrates that ICBC, based on Discounted Cash Flows (DCF), are preferred measures for making optimal ID in the Iraqi context. Obtaining accurate and appropriate financial and non-financial information is identified as a crucial requirement for the preparation of International CB These findings collectively highlight the crucial role of accounting principles and ICBC in guiding ID in the dynamic business landscape.

REFERENCES

Abdullah, Y. A., & Bin Mansor, M. N. (2018). The moderating effect of business environment on the relationship between Entrepreneurial Skills and Small Business performance in Iraq. Journal of Legal, Ethical and Regulatory Issues, 22(Specialiss).

Afework, R (2016). Capital Investment Decisions On Information Technology And Its Impact On The Performance Of Private Commercial Banks In Ethiopia.

Al Ani, M. K (2015). A strategic framework to use payback period (PBP) in evaluating the capital budgeting in energy and oil and gas sectors in Oman. International journal of economics and financial issues, 5(2), 469-475.

Al-Mutairi, A., Naser, K., & Saeid, M (2018). Capital budgeting practices by non-financial companies listed on Kuwait Stock Exchange (KSE). Cogent Economics & Finance, 6(1), 1468232.

Alsharif, A. A (2016). Cash flow forecasting process and its impact on capital budgeting: Evidence from libya (Doctoral dissertation, University of Huddersfield).

Alwan, S. A., Jawad, K. K., Alyaseri, N. H. A., Subhi, K. A., Hussein, E. K., Aned, A. M., Sharaf, H. K., Flayyih, H. H., Salman, M. D., Abdulrasool, T. S., Abdulrasool, T. S., & Abed, R. A. (2023). The Psychological Effects of Perfectionism on Sport, Economic and Engineering Students. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 18(3), 330–333. https://www.riped-online.com/archive/riped-volume-18-issue-3-year-2023.html

Alyaseri, N. H. A., Salman, M. D., Maseer, R. W., Hussein, E. K., Subhi, K. A., Alwan, S. A., zwaid, J. G., Aned, A. M., Jawad, K. K., Flayyih, H. H., Bachache, N. K., & Abed, R. A. (2023). EXPLORING THE MODELING OF SOCIO-TECHNICAL SYSTEMS IN THE FIELDS OF SPORT, ENGINEERING AND ECONOMICS. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 18(3), 338-341.

Baker, H. K., & English, P (Eds.) (2011). Capital budgeting valuation: financial analysis for today's investment projects (Vol. 13). John Wiley & Sons .

Banda, W., Koralalage, Y., Ratnayake, C., & Mudiyanselage, R (2014). The use of capital budgeting techniques in large businesses: Evidence from Sri Lanka.International Journal of Arts and Commerce,3(9), 77-84.

Beyene, A., nigusie, E., & tariku, M (2014). An assessment of capital investment decision in the case of moha soft drink industry sc (doctoral dissertation, st. Mary's university).

Disetia, Y. A., Paminto, A., & Rantelangi, C (2022). Analysis of capital budgeting in the alamjaya barapratama inc east block coal mining decision. International journal economic and business applied, 3(2), 1-11.

Dosh, R. M. A., & Al-Fadhel, M. A. H.(2020). Investment Decisions and Their Relationship to the Opportunity Cost and SWOT Analysis.

Doupnik, T., Finn, M., Gotti, G., & Perera, H (2020). International accounting. Fifth Edition New York: McGraw-Hill .

Flayyih, H. H., & Khiari, W. (2023). Empirically Measuring the Impact of Corporate Social Responsibility on Earnings Management in Listed Banks of the Iraqi Stock Exchange: The Mediating Role of Corporate Governance. Industrial Engineering and Management Systems, 22(3), 321–333. https://doi.org/10.7232/iems.2023.22.3.321

Garang, M (2016). The effect of financial literacy on investment decisions in the Juba City South Sudan (Doctoral dissertation, University of Nairobi).

Gorshkov, A., Murgul, V., & Oliynyk, O (2016). Forecasted payback period in the case of energy-efficient activities. InMATEC Web of Conferences(Vol. 53, p. 01045). EDP Sciences.

Jawad, K. K., Alwan, S. A., Alyaseri, N. H. A., Hussein, E. K., Subhi, K. A., Sharaf, H. K., Hussein, A. F., Salman, M. D., zwaid, J. G., Abed, R. A., Abed, R. A., & Aned, A. M. (2023). Contingency In Engineering Problem Solving Understanding Its Role And Implications: Focusing On The Sports Machine. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 18(3), 334–337.

Kartini, K., & Nahda, K (2021). Behavioral Biases on Investment Decision: A Case Study in Indonesia. The Journal of Asian Finance, Economics and Business, 8(3), 1231-1240.

Kawugana, A., & Faruna, F. S (2019). Role of Financial Statement in Investment Decision Making.

Khan, M. Y., & Jain, P. K.(2011). Financial Management Text, Problems, and Cases. SIXTH EDITION . Tata McGraw Hill Education Private Limited .

Kipkirui, L. P., & Kimungunyi, S (2022). Effect Of Net Present Value Investment Appraisal Practice On Financial Performance Of Cement Manufacturing Firms In Kenya.International Research Journal of Economics and Finance,4(2).

LLCSI, N.D.. Financial and Strategic Management. MODULE 2 .https://www.icsi.edu

Mansour, A.A. (2018). The Impact of the Social and Environmental Dimension of Accounting for Sustainable Development on the Rationalization of Capital Budgeting Decisions in Sudanese Sugar Factories: A Field Study on Some Sudanese Sugar Companies. Journal of the Faculty of Scientific Commerce, Al-Neelain University - Faculty of Commerce, Vol. 6, pp. 118-214.

Maroyi, V (2011). Capital budgeting practices: a South African perspective. Unpublished master thesis, Wageningen: Wageningen University. p31.

Maseer, R. W., Zghair, N. G., & Flayyih, H. H. (2022). Relationship between cost reduction and reevaluating customers’ desires: the mediating role of sustainable development. International Journal of Economics and Finance Studies, 14(4), 330–344. https://doi.org/10.34109/ijefs.20220116

Mieila, M (2017). Modified internal rate of return: Alternative measure in the efficiency of investments evaluation.International Journal of Sustainable Economies Management (IJSEM),6(4), 35-42.

Nehme, A. A., Hasan, A. M., Al-Janabi, A. S. H., Al-Shiblawi, G. A. K., Salman, M. D., Hadi, H. A., Hasan, M. F., Al-Taie, A. H. H., Al-taie, B. F. K., Ali, S. I., Zghair, N. G., Maseer, R. W., Flayyih, H. H., Hussein, M. K., Al-Saedi, A. H., Al-Ibraheemi, S. A. R. A. A., & Jawad, K. K. (2023). The impact of covid-19 on football club stock integration and portfolio diversification. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 15(5), 562–567.

Okanta, S. U (2018). Published Financial Statements, Equity-holders’ Investment Decisions and Bank Performance: A Study of Zenith Bank Nigeria Plc. Balance Sheet, 9(8).

Oppong-Boakye, P. K., & Addai, E (2015, January). Capital Budgeting Practices Of Firms: Empirical Evidence From Ghana. InGlobal Conference on Business & Finance Proceedings(Vol. 10, No. 1, p. 213). Institute for Business & Finance Research.

Priaga, M. A., & Daryanto, W. M (2020). Capital Budgeting Of Mandala Block Under Indonesia’s Gross Split Production Sharing Contract. International Journal of Business, Economics and Law, 23(1), 83-92.

Prodanov, S (2012). Capital Budgeting .Second revised and extended edition. ABAGAR Publishing House ."

Rashem, M. H., & Abdullah, Y. A. (2018). Factors influence the growth and penetration of microfinance institutions: A case of Egypt. Academy of Accounting and Financial Studies Journal, 22(Specialiss).

Saidu, S. K (2014). The Problems and Prospects Of Capital Budgeting Among Nigerian Firms: Literature Analysis. Research Journal of Finance and Accounting, 5(4), 72-75.

Salman, M. D., Alwan, S. A., Alyaseri, N. H. A., Subhi, K. A., Hussein, E. K., Sharaf, H. K., Bachache, N. K., Jawad, K. K., Flayyih, H. H., Abed, R. A., zwaid, J. G., & Abdulrasool, T. S. (2023). The Impact of Engineering Anxiety on Students: A Comprehensive Study in the Fields of Sport, Economics, and Teaching Methods. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 18(3), 326–329. https://www.riped-online.com/archive/riped-volume-18-issue-3-year-2023.html

Sapkota, S (2010). Capital Budgeting Practices in Manufacturing Companies of Nepal (Doctoral dissertation, Central Department of Management).

Schönbohm, A., & Zahn, A (2016). Reflective and cognitive perspectives on international capital budgeting. critical perspectives on international business, 12(2), 167-188.

Subedi, B. S (2011). Capital Budgeting Practices in Industrial Sector of Public Enterprises of Nepal (Doctoral dissertation, Faculty of Management).

Tembo, B (2018). Strategic investment decisions in Zambia’s mining sector under a constrained energy system (Doctoral dissertation, UCL (University College London)).

Wankel, C (Ed.) (2009). Encyclopedia of Business in Today's World: A-C (Vol. 1). Sage .