Full Length Research Article - (2023) Volume 18, Issue 4

The Role Of The Iraqi Foreign Reserve In Limiting The Deterioration Of The Value Of The Iraqi Currency In Light Of The Financial Crisis (Low Oil Prices And Fluctuations In The Exchange Rate)

Sundas Ali Khalifa1* and Faten Zoghlami2*Correspondence: Sundas Ali Khalifa, Ministry of Higher Education and Scientific Research Administrative and financial department;, Tunisia, Email:

Abstract

The aim of conducting this study is to demonstrate the importance of the role of foreign reserves in supporting the value of the national currency (the Iraqi dinar) and its promotion of the exchange rate of the Iraqi dinar, and its role in reducing the devaluation of the currency in light of crises (financial, political, health) in the presence of sound management of foreign reserves under international standards that avoid potential risks by the Central Bank of Iraq. s 12) To analyze and test hypotheses for the fiscal period (2004-2021), the researcher recommended a set of recommendations, the most important of which is diversifying foreign reserves in a way that guarantees investment in them and not leaving them in a way that costs keeping them for their safety in the face of possible shocks, diversifying sources of obtaining foreign currency and not being limited only to what Iraq gets from oil, raising the efficiency of the industrial, agricultural and service sectors, and achieving sufficiency in Iraq to work side by side with the oil sector to supplement the balance of foreign reserves, encouraging export of products Agricultural and industrial abroad with the aim of obtaining foreign currencies to increase foreign reserves, reduce the value of unnecessary imports as they deplete the value of hard currency and lose it abroad, and work to direct foreign reserves and invest them in important and useful sectors such as education, industry, agriculture and health, which are among the dilapidated infrastructures, and develop new mechanisms to work within the currency sale window to limit the flight of hard currencies abroad.

Keywords

Central bank of iraq. Foreign reserves. Exchange rate. Imports. Exports. Oil prices. Foreign currency sale window sales

Introduction

The motives for the demand for foreign reserves varied economically and financially, as there are those who seek to obtain them with the aim of safety or hedging in anticipation of any possible financial crises that may occur. Agricultural and industrial, but it depends mainly on revenues from the sale of oil, and this affects negatively or positively on foreign reserves due to the mechanism of global supply and demand for oil, which in turn also affects the value of the national currency.

Section one

Research Methodology and Previous Studies

First: the study problem

During the seventies of the twentieth century, the international monetary system was exposed to many changes of varying importance, including the transition to work to a flexible exchange rate after it was fixed, which led to many countries possessing foreign exchange reserves, and this was proven by thinkers and economists, as the major and economically and financially developed countries were characterized by relative stability by retaining foreign reserves compared to developing countries because they are directly related and close to the international capital markets. Dinar in light of the collapse in the decline in Iraqi oil prices and fluctuations in exchange rates, according to the following questions:

1. What is the extent of the impact of foreign reserves in maintaining the value of the currency?

2. Is there a role for foreign reserves in the depreciation and increase in the value of the currency?

3. Does the foreign reserve contribute to preserving the value of the currency in economic and financial crises and low oil prices?

4. The impact of oil imports on the volume of foreign reserves.

5. What are the monetary and financial effects as a result of the decrease in the value of the currency (the dinar).

Second: the importance of the study

The importance of the study is highlighted by showing the importance of the theoretical frameworks for foreign reserves and the extent of their impact in supporting and strengthening the national economy with the role of foreign reserves in supporting the value of the national currency (the Iraqi dinar), and strengthening the exchange rate of the Iraqi dinar. Reducing currency depreciation in light of crises (financial, political, and health).

Third: study objectives

The research seeks a set of objectives:

1. Statement of the concept of foreign reserves and their role in preserving the value of the national currency (the dinar).

2. Knowing the impact of the volume of oil exports on the volume of foreign reserves.

3. Statement of the effect of the volume of imports on the volume of foreign reserves.

4. The role of foreign reserves in the gross domestic product.

5. Statement of the effectiveness of foreign reserves in stabilizing the exchange rates of the national currency (Is there a relationship between the two variables).

6. Standing on the role of foreign reserves on the exchange rate in crises (financial (low oil prices) and political (war on ISIS) and (health (Covid-19).

Fourth: the hypotheses of the study

1. The first main hypothesis: the role of the Iraqi foreign reserves on the exchange rate

2. The second main hypothesis: the role of the Iraqi foreign reserves on the exchange rate in light of the (political, financial and health) crises, and the following hypotheses emerge from it:

3. The role of Iraqi foreign reserves on the exchange rate in light of the financial crisis (low oil prices).

4. The role of Iraqi foreign reserves on the exchange rate in light of the political crisis (the war against ISIS).

5. The role of the Iraqi foreign reserve on the exchange rate in light of the health crisis (COVID-19 pandemic).

Fifth: the limits of the spatial and temporal study

1. Spatial boundaries: The spatial boundaries of the study are the Iraqi banking system (the Central Bank of Iraq).

2. Temporal limits: The limits of the temporal study represent the period from (2004 to 2021), in which the researcher considers it appropriate in the completion of the research, as it has followed economic and financial changes in Iraq in light of the drop in oil prices and globally, the entry of the so-called al-Qaeda organization (ISIS) to Iraq, and finally the period in which COVID-19 invaded the world, as this caused changes in the volume of foreign reserves in Iraq.

Fifth: previous studies

1. A study (Ismail, Iman Ibrahim and Faraj, Mardin Mahsum and Bilal, Ahmed Taha 2019): It was devoted to studying some economic and political factors on the exchange rate of the Iraqi dinar during the period (2004-2018), with the aim of analyzing and measuring the economic and noneconomic factors that affect the exchange rate of the Iraqi dinar during the research period. Despite the importance of non-economic factors and their impact on the exchange rate of the Iraqi dinar, but those factors (global financial crisis / 2008, security instability) were not significant and the reason is due to the use of foreign reserves by the Central Bank in order to cover the negative effects of non-economic variables. clearly and accurately.

2. Study (Badr, Osama Muhammad and Al-Baramawy, Adham Muhammad Al-Sayed, 2021): The study aimed to know the role of foreign reserves in their ability to absorb the negative effects of the Corona pandemic, with an indication of the cost of those reserves in the foreign economy by preserving their values, from the results, foreign reserves played a major role in absorbing and reducing the negative effects of Corona by maintaining a second economic level in the world during the year (2020) after China, and the recommendations should be diversification in the sources of obtaining foreign reserves, and also the monetary authorities in the country By forming a sovereign fund that is managed by specialists and experts, the monetary authority reduces and reduces the financial and social cost in return for obtaining foreign reserves by investing them in a way that achieves high returns.

3. Study ) Romer Ana Maria:( 2005: The researcher showed that the size of large reserves reduces the possibility of a currency crisis, the possession of large reserves is associated with lower costs of external borrowing due to improving confidence and raising the credit rating of foreign currency debts and the effect on exchange rate regimes, the researcher recommended that many economies of developing and transitional countries, especially those that lack developed financial infrastructure, including sophisticated financial institutions and wide and deep markets for foreign currencies do not satisfy the requirements of successful flotation, and that the current exchange rate under the above study period should not be a fixed element The appropriate system for a particular country may change over time.

Section two

The concept of reserves, oil prices, exchange and the role of the financial crisis in affecting them

First: the concept of reserves and their definition

The concept of foreign reserves appears clearly in international trade transactions, where every country needs financing to conduct transactions, and among the sources of financing is the foreign exchange reserve, which is defined as foreign currency deposits with central banks and monetary authorities with foreign exchange reserves and kept for the purpose of covering financial obligations arising from international transactions in the reserve currency, where there is a causal relationship (unidirectional) between the variable foreign exchange reserves and the exchange rate, which means that the reserves in many of them are (the assets of foreign assets that fall under the control and disposal of the monetary authority in order to be sufficient to meet the needs of The trade balance of payments or its effective role to intervene in the exchange markets to influence the currencies it owns, as well as its relationship to preserving the prevailing local currency of a country, provided that those assets are from foreign currency reserves and actually exist after excluding what is actually used from it) (International Monetary Fund, 2009: 111),

Second: the concept and definition of oil prices

Oil is considered one of the primary commodities because it is associated with mining and extraction, and these commodities have one of their recognized characteristics that they are volatile in their values, and the elasticity of demand for them is very low due to their high sensitivity to excess supply and demand for them. They are called a group of commodities with soft or elastic values compared to the commodities of the manufacturing industry, and according to the British Oil Company (BP), the value of the price of oil is calculated for purchasing power (Ali, 2020: 8) and there are many different concepts of oil prices depending on the different stages of development Its historical discovery and production and the challenges associated with it, as the price of oil is linked to a set of factors surrounding it as a productive and consumer commodity (Omar, 2013: 137).

Third: the concept of exchange rate

The exchange rate was defined as the unit price of the foreign monetary currency in exchange for units of the local or national currency, or it is the unit price of the national or local currency expressed in foreign currency (Ben Al-Zawi, 2017: 14), and the exchange rate was defined as an economic term as the rate or base price through which the exchange of one currency for another currency or in gold takes place (Al-Moumani and Al-Mousa, 2021: 184).

Fourth: defining the financial crisis

There is a lot of cognitive and philosophical debate about the definition and interpretation of the concept of financial crisis, depending on the different cases of the financial markets, which were exposed to many financial crises and the different degrees of risk associated with the crisis and the reasons for the occurrence of each financial crisis (Al-Amri, 2013: 589), where: The financial crisis: It is a state of financial changes in the financial markets and their tools (up or down in one direction) and are often contrary to expectations (Al-Dulaimi, 2013: 46).

Section three

Practical side

In this section, we will discuss the financial analysis of the variables of the study and discuss the hypotheses of the research by conducting a statistical analysis of the results in order to come up with a final outcome of the conclusions, which in turn put appropriate recommendations in the light of proving or refuting the hypotheses of the research.

First: economic ratios and indicators

1- Analysis of the ratio of the relationship between foreign reserves and imports (Table 1)

| year | Foreign reserves | imports | exchange rate | imports billion dinars | importance of reserves to imports | number of months covered by reserves to imports |

|---|---|---|---|---|---|---|

| 2004 | 13,652 | 21,302 | 1453 | 30,951 | 44% | 5 |

| 2005 | 19,901 | 20,002 | 1469 | 29,382 | 68% | 8 |

| 2006 | 27,763 | 18,707 | 1467 | 27,443 | 101% | 12 |

| 2007 | 40,196 | 18,288 | 1255 | 22,951 | 175% | 21 |

| 2008 | 58,841 | 30,171 | 1193 | 35,994 | 163% | 20 |

| 2009 | 51,872 | 32,673 | 1170 | 38,227 | 136% | 16 |

| 2010 | 59,252 | 37,328 | 1170 | 43,673 | 136% | 16 |

| 2011 | 71,411 | 40,633 | 1170 | 47,540 | 150% | 18 |

| 2012 | 82,001 | 47,799 | 1166 | 55,733 | 147% | 18 |

| 2013 | 90,649 | 49,977 | 1166 | 58,272 | 156% | 19 |

| 2014 | 77,363 | 45,200 | 1166 | 52,703 | 147% | 18 |

| 2015 | 62,810 | 33,188 | 1187 | 39,394 | 159% | 19 |

| 2016 | 52,618 | 29,138 | 1190 | 34,673 | 152% | 18 |

| 2017 | 57,893 | 32,951 | 1190 | 39,211 | 148% | 18 |

| 2018 | 76,017 | 38,876 | 1190 | 46,262 | 164% | 20 |

| 2019 | 79,918 | 49,418 | 1190 | 58,806 | 136% | 16 |

| 2020 | 78,293 | 40,927 | 1450 | 59,344 | 132% | 16 |

| 2021 | 92,527 | 34,721 | 1450 | 50,345 | 184% | 22 |

The highest percentage of coverage of foreign reserves for imports was in the year (2021), when it reached (22) months, as the reserves witnessed an amount of (92,527) dinars due to the increase in oil prices and the quantities exported and a decrease in imports, while foreign reserves covered imports for a period of (5) months In the year (2004), which is the lowest during the years of the study, as imports amounted to (30,951) dinars and reserves were (13,652) dinars, covering 5 months, because there was a rise in the volume of spending in imports with a decrease in the volume of reserves due to the absence of an increase in Quantities of oil sold. As for the rest of the years of the study from (2005 to 2020), the number of months ranged from (8-21) months, as it did not exceed the number of months specified in the rules, which are (3) months by the International Monetary Fund.

2- The ratio of coverage of reserves to GDP at current prices (Table 2) The percentage determined according to the standards of the International Monetary Fund for developing countries is (20% to 40%). In economically and financially developed countries, the percentage ranges from (9% to 12%), as the financial analysis showed that the year (2017) is the lowest percentage, amounting to (25%). ) against a foreign reserve (57,893) dinars as a result of the drop in oil prices, while the largest percentage was in the year (2020), which was (177%), as the reserves amounted to (78,293) dinars due to the increase in the volume of reserves as a result of the increase in the quantities exported from oil. In the remaining years of study within the internationally applicable limit.

| year | foreign reserves | gross domestic product | Ratio of foreign reserves to output | Index ratio | importance of reserves to imports | number of months covered by reserves to imports |

|---|---|---|---|---|---|---|

| 2004 | 13,652 | 47,959 | 28% | 44% | 5 | |

| 2005 | 19,901 | 64,000 | 31% | 9% | 68% | 8 |

| 2006 | 27,763 | 95,588 | 29% | -7% | 101% | 12 |

| 2007 | 40,196 | 107,828 | 37% | 28% | 175% | 21 |

| 2008 | 58,841 | 155,992 | 38% | 1% | 163% | 20 |

| 2009 | 51,872 | 139,330 | 37% | -1% | 136% | 16 |

| 2010 | 59,252 | 159,254 | 37% | 0% | 136% | 16 |

| 2011 | 71,411 | 212,255 | 34% | -10% | 150% | 18 |

| 2012 | 82,001 | 251,908 | 33% | -3% | 147% | 18 |

| 2013 | 90,649 | 272,346 | 33% | 2% | 156% | 19 |

| 2014 | 77,363 | 259,831 | 30% | -11% | 147% | 18 |

| 2015 | 62,810 | 209,398 | 30% | 1% | 159% | 19 |

| 2016 | 52,618 | 205,676 | 26% | -15% | 152% | 18 |

| 2017 | 57,893 | 228,693 | 25% | -1% | 148% | 18 |

| 2018 | 76,017 | 258,035 | 29% | 16% | 164% | 20 |

| 2019 | 79,918 | 281,485 | 28% | -4% | 136% | 16 |

| 2020 | 78,293 | 201,249 | 39% | 37% | 132% | 16 |

| 2021 | 92,527 | 301,439 | 31% | -21% | 184% | 22 |

| Reserve ratio to GDP | 32% |

3- Analysis of the relationship between oil exports and foreign reserves for the period (2004-2021) (Table 3)

| year | Foreign reserves | oil exports/billion | export growth rate | price of a barrel of oil | importance of reserves to exports | number of months covered by reserves to imports |

|---|---|---|---|---|---|---|

| 2004 | 13,652 | 17,810 | 43.1 | 77% | 5 | |

| 2005 | 19,901 | 23,199 | 28% | 45.6 | 86% | 8 |

| 2006 | 27,763 | 29,708 | 28% | 55.6 | 93% | 12 |

| 2007 | 40,196 | 37,771 | 27% | 66.7 | 106% | 21 |

| 2008 | 58,841 | 63,726 | 69% | 87.9 | 92% | 20 |

| 2009 | 51,872 | 38,964 | -39% | 59.4 | 133% | 16 |

| 2010 | 59,252 | 51,453 | 32% | 76 | 115% | 16 |

| 2011 | 71,411 | 79,418 | 54% | 103 | 90% | 18 |

| 2012 | 82,001 | 93,779 | 18% | 107 | 87% | 18 |

| 2013 | 90,649 | 89,350 | -5% | 103 | 101% | 19 |

| 2014 | 77,363 | 83,539 | -7% | 95 | 93% | 18 |

| 2015 | 62,810 | 43,059 | -48% | 45 | 146% | 19 |

| 2016 | 52,618 | 40,494 | -6% | 36 | 130% | 18 |

| 2017 | 57,893 | 57,130 | 41% | 49 | 101% | 18 |

| 2018 | 76,017 | 85,799 | 50% | 66 | 89% | 20 |

| 2019 | 79,918 | 78,365 | -9% | 60 | 102% | 16 |

| 2020 | 78,293 | 44,306 | -43% | 41 | 177% | 16 |

| 2021 | 92,527 | 68,804 | 55% | 68 | 134% | 22 |

From the table above, where there is a direct relationship between crude oil exports and the volume of foreign reserves, where oil is the main component of the volume of its trade with the outside world, and this is shown by the trade balance of payments of the Iraqi state. Table No. (3) shows that in the year (2016) we notice a decrease in the price of a barrel of oil to ( 36) dollars, which affected the volume of foreign reserves to become (52,618), compared to oil sales amounting to (40,494) dinars, and the highest sales were in the year (2012) by (93,779) dinars at a price per barrel of (107) dollars due to The increase in global oil prices, which caused an increase in the volume of reserves to reach (82,001) dinars.

4- (Analysis of the ratio of covering the volume of foreign reserves to the volume of the broad money supply, M2 (Table 4)

| year | foreign reserves | M2 broad money supply | Reserves Index to Broad Money Supply % |

|---|---|---|---|

| 2004 | 13,652 | 11,517 | 119% |

| 2005 | 19,901 | 13,016 | 153% |

| 2006 | 27,763 | 21,050 | 132% |

| 2007 | 40,196 | 26,919 | 149% |

| 2008 | 58,841 | 34,920 | 169% |

| 2009 | 51,872 | 45,438 | 114% |

| 2010 | 59,252 | 60,289 | 98% |

| 2011 | 71,411 | 72,067 | 99% |

| 2012 | 82,001 | 75,466 | 109% |

| 2013 | 90,649 | 87,679 | 103% |

| 2014 | 77,363 | 90,728 | 85% |

| 2015 | 62,810 | 82,595 | 76% |

| 2016 | 52,618 | 88,082 | 60% |

| 2017 | 57,893 | 89,441 | 65% |

| 2018 | 76,017 | 95,391 | 80% |

| 2019 | 79,918 | 103,441 | 77% |

| 2020 | 78,293 | 119,906 | 65% |

| 2021 | 92,527 | 139,886 | 66% |

At the beginning, we must know that there is a direct relationship between the reserve and the wide money supply, and that the optimal size for that is the ratio (10-20%) in a country like Iraq because it follows a fixed monetary system and its banking system is almost weak compared to the major developed countries and through Table No. (4) We will analyze that ratio and its impact on the money supply. In the year (2016), the ratio was (60%), which is the lowest during the years of study, with a foreign reserve of (52,618) dinars, compared to a money supply of (88,082) dinars because of the war he waged. Iraq with the so-called ISIS and the drop in the price of a barrel of oil, while the highest percentage reached in the year (2008), when it reached (169%) with a wide cash offer of (34,920) dinars against a reserve capacity of (58,841) dinars as a result of being affected by the financial crisis in 2008. (2008) Through the above table, we notice that the percentages did not exceed what is in force.

5- The ratio of the volume of foreign reserves to the value of the exported currency (Table 5)

| year | foreign reserves | issued currency | Reserves index to the issued currency |

|---|---|---|---|

| 2004 | 13,652 | 8,020 | 170% |

| 2005 | 19,901 | 10,256 | 194% |

| 2006 | 27,763 | 11,916 | 233% |

| 2007 | 40,196 | 15,632 | 257% |

| 2008 | 58,841 | 21,304 | 276% |

| 2009 | 51,872 | 24,169 | 215% |

| 2010 | 59,252 | 27,507 | 215% |

| 2011 | 71,411 | 32,157 | 222% |

| 2012 | 82,001 | 35,784 | 229% |

| 2013 | 90,649 | 40,630 | 223% |

| 2014 | 77,363 | 39,883 | 194% |

| 2015 | 62,810 | 38,585 | 163% |

| 2016 | 52,618 | 45,231 | 116% |

| 2017 | 57,893 | 44,236 | 131% |

| 2018 | 76,017 | 44,264 | 172% |

| 2019 | 79,918 | 51,834 | 154% |

| 2020 | 78,293 | 66,031 | 119% |

| 2021 | 92,527 | 76,561 | 121% |

Article (31) of the Central Bank of Iraq Law No. (56) for the year (2004) specified that the dinar be the monetary unit adopted in Iraq. Article (32) of the above law states that the central bank is the only entity responsible for issuing the Iraqi currency, whether it is Paper or metal, and one of the objectives pursued by the monetary policy is the stability of the value of the local currency towards exchange rates, and the law obligated the bank to keep 100% of the volume of foreign reserves to cover the value of the local currency from the above table. In the year (2008), the percentage reached (276%) Against a foreign reserve (58,841) dinars, because there is an increase in the quantities of oil exported and constituting the foreign reserves, and the lowest percentage witnessed in 2016, when it reached (116%), and the percentage decreased because Iraq went through a difficult political and security situation due to the occupation of the so-called ISIS organization on its lands, which caused Confusion in its oil exports, while the percentage ranged between the remaining years from (119% to 257%). The changes in the percentages came as a result of fluctuations in oil selling prices.

6- Analysis of the foreign currency sale window (Table 6)

| year | foreign reserves | window sales | The exchange rate of the dinar at the official rate | The exchange rate of the dinar at the market price | Sales window sales growth rate | Reserve ratio to sales | The number of months covered by currency sales |

|---|---|---|---|---|---|---|---|

| 2004 | 13,816 | 6,006 | 1,453 | 1,453 | 230% | 28 | |

| 2005 | 17,996 | 10,463 | 1,469 | 1,472 | 74% | 172% | 21 |

| 2006 | 26,346 | 11,175 | 1,467 | 1,475 | 7% | 236% | 28 |

| 2007 | 42,351 | 15,980 | 1,255 | 1,267 | 43% | 265% | 32 |

| 2008 | 58,841 | 25,869 | 1,193 | 1,203 | 62% | 227% | 27 |

| 2009 | 51,873 | 33,992 | 1,170 | 1,182 | 31% | 153% | 18 |

| 2010 | 59,252 | 36,171 | 1,170 | 1,185 | 6% | 164% | 20 |

| 2011 | 71,410 | 39,798 | 1,170 | 1,196 | 10% | 179% | 22 |

| 2012 | 82,001 | 48,649 | 1,166 | 1,233 | 22% | 169% | 20 |

| 2013 | 90,648 | 53,231 | 1,166 | 1,232 | 9% | 170% | 20 |

| 2014 | 76,227 | 51,728 | 1,166 | 1,214 | -3% | 147% | 18 |

| 2015 | 62,810 | 44,304 | 1,187 | 1,247 | -14% | 142% | 17 |

| 2016 | 52,618 | 33,524 | 1,190 | 1,275 | -24% | 157% | 19 |

| 2017 | 57,893 | 42,201 | 1,190 | 1,258 | 26% | 137% | 16 |

| 2018 | 76,017 | 47,133 | 1,190 | 1,208 | 12% | 161% | 19 |

| 2019 | 79,918 | 51,127 | 1,190 | 1,196 | 8% | 156% | 19 |

| 2020 | 78,293 | 44,080 | 1,450 | 1,460 | -14% | 178% | 21 |

| 2021 | 92,527 | 37,094 | 1,450 | 1,460 | -16% | 249% | 30 |

| Ratio rate | 157% | ||||||

We note above that the percentage of sales recorded by the currency sale window was in the year (2013), when it amounted to (53,231) fifty-three, two hundred and thirty-one million dollars, at an official exchange rate of (1,166) for one US dollar, and an exchange rate in the parallel market amounted to (1,232) against the Iraqi dinar, at a rate A growth of (9%) over what it was in the year (2012), due to strengthening the bank account, where there is a demand for it to meet the requirements of current and investment expenditures.

We also note from the table that the exchange rate of the dollar against the Iraqi dinar was maintained for the quantities sold in the currency sale window at exchange rates of (1,170, 1,170, 1,170, 1.166, 1,166, 1,166, 1,190, 1,190, 1,190) for the years (2009, 2010, 2011, 2012, 201 3 , 2014, 2016, 2017, 2018, 2019) respectively against exchange rates in the parallel market amounting to (1,182, 1,185, 1,196, 1,233, 1,233, 1,214, 1,275, 1,258, 1,208, 1,196) also, respectively, as we note There is a difference between The official price of sale by the central bank and the exchange rate in the parallel market. It is clear that the goal of the central bank selling the dollar is to ensure the stability of the Iraqi dinar exchange rate against the US dollar. Without this process, there would have been speculations to raise the value of the dollar in the parallel market, which is reflected in the depreciation of the Iraqi dinar. Where the central bank controls that in a way that suits the size of the appropriate demand, and in the years (2020-2021) the exchange rate of the dollar against the Iraqi dinar increased at a rate of (1,450), while the exchange rate in the parallel market reached (1,460), due to the large increase in demand for the dollar as a result of the increase in the volume of Foreign trade with Turkey and Iran for imports of imported food and clothing, gas, electrical appliances, industrial machinery, and cars from (China and Western industrialized countries), in addition to smuggling currency to neighboring countries, as all of this causes the depletion of foreign reserves that depend on oil almost completely and reduces the value of the Iraqi dinar We also note that the coverage of foreign reserves amounted to (157%) of the quantities sold from the dollar and did not decrease to less than (100%), which is reflected positively in supporting the value of the Iraqi dinar. As for the months covered by the reserves for the currency sale window, it ranged from (16 to 30) months. Which requires taking preventive measures to support the volume of reserves by relying on other production sectors and not being satisfied with oil as a basic resource to obtain dollars while reducing unnecessary imports.

Second: descriptive statistics

Descriptive statistics of all variables during the study period from (2004) to (2021). Table No. (7) below is devoted to presenting the arithmetic mean, median, standard deviation, and upper and lower limits for all variables, as in the following table: (Table 7)

| Variable | Mean | Median | Maximum | Minimum |

|---|---|---|---|---|

| Y | 1260.67 | 1190.00 | 1469.00 | 1166.00 |

| X1 | 60720.94 | 61031.00 | 92527.00 | 13652.00 |

| X2 | 34516.51 | 33954.65 | 49976.50 | 18288.00 |

| X3 | 191792.60 | 207537.00 | 301439.00 | 47959.00 |

| X4 | 57037.44 | 54291.50 | 93779.00 | 17810.00 |

| X5 | 69879.50 | 79030.50 | 139886.00 | 11517.00 |

| X6 | 35222.22 | 37184.50 | 76561.00 | 8020.00 |

| X7 | 35140.28 | 38446.00 | 53231.00 | 6006.00 |

Exchange rate (y): It turned out that the highest value of the exchange rate was (1469), while the lowest value of the exchange rate was (1166), with an arithmetic mean of (1230.67) and a standard deviation of (127.47).

Iraqi foreign reserve (x1): It was found that the highest value of the Iraqi foreign reserves amounted to (92527), while the lowest value of the Iraqi foreign reserves amounted to (13652), with an arithmetic mean of (60720.94) and a standard deviation of (23280.81).

Imports (x2): It turned out that the highest value of imports amounted to (49976.5), while the lowest value of imports amounted to (18288), with arithmetic mean of (34516.51) and a standard deviation of (10321.56).

Current prices (x3): It was found that the highest value of current prices amounted to (301439), while the lowest value of current prices amounted to (47959), with an arithmetic mean of (191792.6) and a standard deviation of (76687.57).

Oil exports (x4): It turned out that the highest value of oil exports amounted to (93779), while the lowest value of oil exports amounted to (17810), with an arithmetic mean of (57037.44) and a standard deviation of (24075.24).

Wide cash supply (x5): It was found that the highest value of the broad money supply amounted to (139886), while the lowest value of the broad money supply amounted to (11517), with an arithmetic mean of (69879.5) and a standard deviation of (37278.77).

Issued currency (x6): It was found that the highest value of the exported currency amounted to (76561), while the lowest value of the exported currency amounted to (8020), with an arithmetic mean of (35222.22) and a standard deviation of (18684.43).

Currency sell window (x7): It was found that the highest value of the currency selling window amounted to (53231), while the lowest value of the currency selling window amounted to (6006), with an arithmetic mean of (35140.28) and a standard deviation of (15173.01).

Test the correlation coefficient between the variables of the study

The correlation coefficient measures the degree of linear correlation between two variables, and the correlation coefficients for the study variables were as in the table below: (Table 8)

| Correlation | Y | X1 | X2 | X3 | X4 | X5 | X6 | X7 |

|---|---|---|---|---|---|---|---|---|

| Y | 1.000 | |||||||

| Probability | ----- | |||||||

| X1 | -0.457 | 1.000 | ||||||

| Probability | 0.057 | ----- | ||||||

| X2 | -0.552 | 0.880 | 1.000 | |||||

| Probability | 0.018 | 0.000 | ----- | |||||

| X3 | -0.472 | 0.946 | 0.836 | 1.000 | ||||

| Probability | 0.048 | 0.000 | 0.000 | ----- | ||||

| X4 | -0.595 | 0.862 | 0.857 | 0.850 | 1.000 | |||

| Probability | 0.009 | 0.000 | 0.000 | 0.000 | ----- | |||

| X5 | -0.209 | 0.870 | 0.707 | 0.907 | 0.602 | 1.000 | ||

| Probability | 0.405 | 0.000 | 0.001 | 0.000 | 0.008 | ----- | ||

| X6 | -0.073 | 0.816 | 0.613 | 0.841 | 0.500 | 0.982 | 1.000 | |

| Probability | 0.773 | 0.000 | 0.007 | 0.000 | 0.035 | 0.000 | ----- | |

| X7 | -0.636 | 0.910 | 0.930 | 0.912 | 0.817 | 0.816 | 0.717 | 1.000 |

| Probability | 0.005 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.001 | ----- |

The above table indicates that there is a significant negative relationship between the dependent variable (the exchange rate) and the independent variable (imports), as well as the existence of a significant negative relationship between the dependent variable (the exchange rate) and the control variables (current prices, oil exports and the currency selling window) where the foreign exchange rate affects The national currency is depleted in the volume of reserves due to the increase in unnecessary imports. The same applies to oil exports and the currency that is sold at the official or market exchange rate in the currency sale window that the Central Bank of Iraq resorts to obtain the quantities bought and sold by it.

Testing the stability of the data (stillness) for the study variables

The stability of time series is one of the important topics for many statistical applications that depend on a time series for economic and financial data with a specific time period. It is a topic of importance for standard analysis, as inference about unstable variables gives misleading results, i.e. the results between variables are unstable and not real. This is called false or misleading regression, and there are many statistical methods used to test stability, and we will adopt one of them, which is one of the most widespread methods, which is the unit root test, as the unit root test aims to examine the properties of the time series for each variable of the study during a period of time for observations And make sure of its stability and determine the degree of integration of each variable separately. If the time series stabilizes after taking the first difference, the original series will be integrated of the first order, but if the series stabilizes in the second difference, the time series will be integrated of the second order.

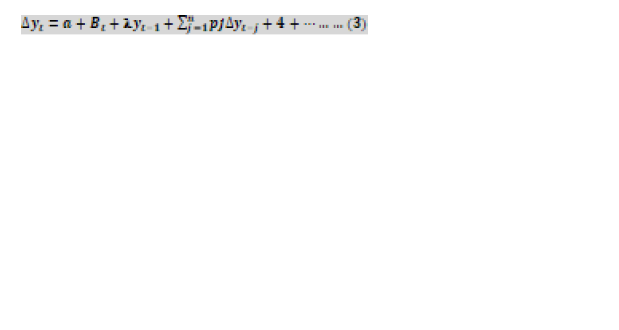

In order to test the stability of the time series and determine its degree of integration, we will use the extended Dickie Fuller test:

Dickie fuller's expanded test

After the criticisms directed at the simple (Dickie-Fuller) test, as the researchers Dickie and Fuller developed this test in 1981 and called it the (Extended Dickey- Fuller) test, these tests have proven its efficiency through modern applied economic studies used in the analysis of time series, as it is more efficient than Methods used to process data that suffer from root unity since it does not keep error correlation between residuals can be described by the model.

The Expanded Dickie Fuller Selection (ADF) is one of the unit root tests and depends on three elements to ascertain whether or not the time series is still, which is the formula of the model used, the size of the sample, and the level of significance (0). It is noted in this regard that there are three formulas of the model that can be used In the case of (ADF) as follows (Atiyah, Abdel-Qader Mohamed Abdel-Qader, 2001: 658-662).

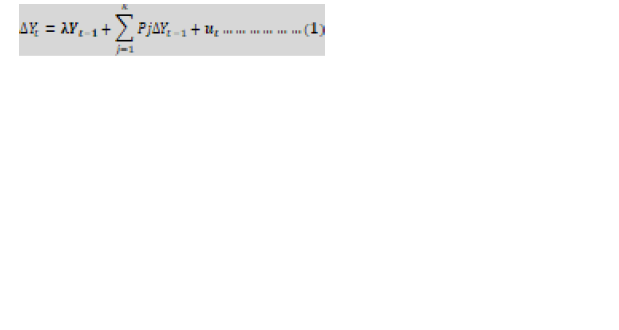

The first version: without a fixed limit or time direction

It is noted in this formula that it does not contain a fixed limit or time

direction. The assumptions in this case are as follows:

0 or p =1 = λ Null hypothesis:

0 or p < 1 > λ : Alternative hypothesis

Δy t-1=y t-1- y t-2………...(1,1)

Δy t-2=y t-2- y t-3………...(1,2)

Δy t-3=y t-3- y t-4………...(1,3)

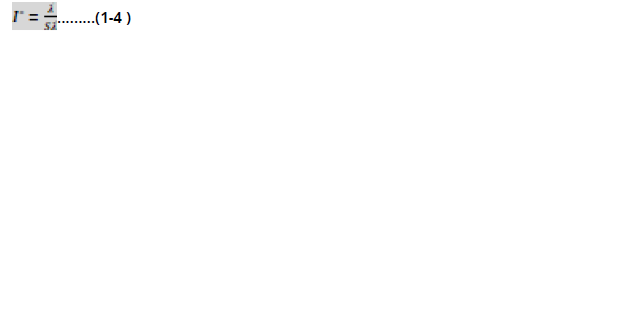

Then the formula is estimated and then the Dickie-Fuller expanded tau is calculated according to the following formula:

And then obtain the critical value (ADFλ (i,n,e) for the sample i, the sample size n, and the level of significance e.

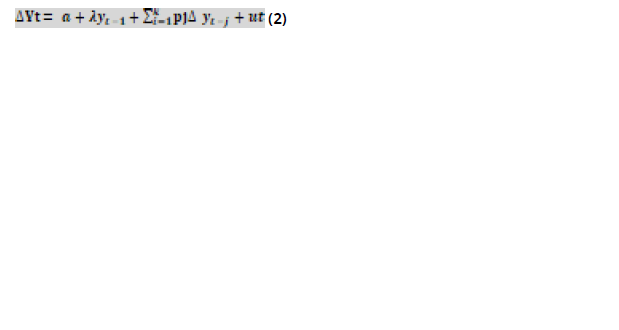

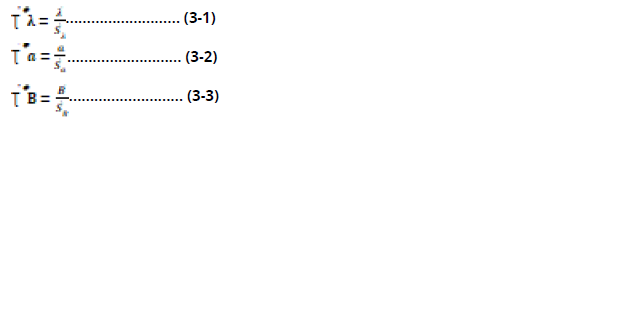

The second formula: with only a fixed limit

This formula differs from the first formula because it contains a fixed term

The hypotheses to be tested in this formula are:

A=0 0 or p=1=λ the null hypothesis:

: a ≠0 1 0 or p< > λ

alternative duty:

After estimating the test formula, the expanded Dickey-Fuller tau is

calculated using the previous formula, or the tau of the vector parameter using the following formula:

Then the critical values for each of (λ, a) are searched as follows:

The critical value of (λ) is: ADF λ (II,n,e)

The critical value of (a) is: ADF a (II,n,e)

Then the calculated value is compared to the tabular values

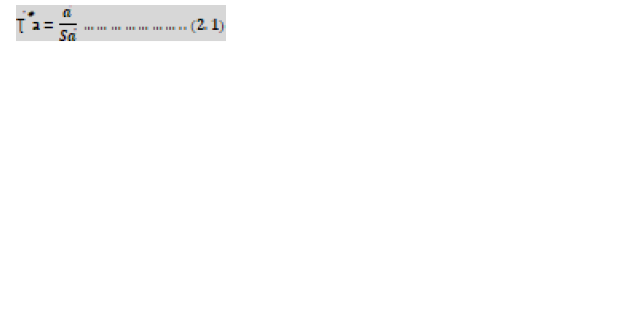

The third formula: the existence of a fixed limit with a time trend. This formula contains a fixed limit and a time direction

The hypotheses to be chosen in this formula are:

A=0 H0: λ=o or p=1

0 B≠ H0: λ<0 or p<1 a≠0

The estimate of the test formula is the expanded Dickey-Fuller tau Ʈ^(̂*) λ is calculated using the previous formula, and the tau of the vector parameter Ʈ^(̂*) a is calculated using the following formula:

Then, the limit values for each of (a, B, λ) are searched as follows:

The critical value (λ) is: (e, a, III) A D Fλ

The critical value (A) is: (e, a, III) A,D,Fa

The critical value (B) is: (e, a, III) A,D,Fb

It is possible to judge the result of the test, if the P-Value is less than (5%), this means that the parameter is significant and the series is static, but if the P-Value is greater than (5%), then this means that the parameter is not significant and the series is not Stable, or we compare the calculated (F) value with the tabular (F) value. If the calculated (F) value is greater than the tabular value, then we reject the null hypothesis (Ho) and accept the alternative hypothesis (H1)) meaning that the series is stable, but if the opposite is the case, this means that The series is not stable and requires taking the first difference and then taking the second difference and so on until a stable time series is obtained (Table 9).

| Variable | Statistic | Prob. |

|---|---|---|

| Y | -3.295 | 0.033 |

| X1 | -2.330 | 0.023 |

| X2 | -3.832 | 0.047 |

| X3 | -4.322 | 0.005 |

| X4 | -3.659 | 0.018 |

| X5 | -4.083 | 0.032 |

| X6 | -4.369 | 0.005 |

| X7 | -3.946 | 0.039 |

Table (9) shows the results of the stability test of the study data, using the expanded Dickie-Fuller test. It also shows that all the time series data used in the study are stable with the passage of time because all the probability values of the variables are less than (0.05), which indicates that there is no unit root and the time series is stable.

Third: testing the hypotheses of the study

In order to analyze the variables of the study, the (Eviews12) program was used, during the period from 2004 to 2021, and thus the number of observations is (18) observations for each variable of the study. Also, in this section of the study, the use of multiple linear regression analysis will be presented to test the hypotheses of the study.

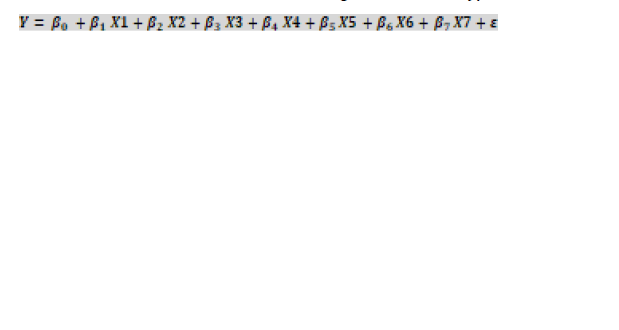

Study models

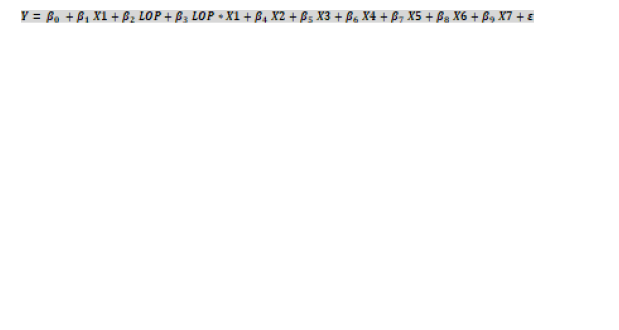

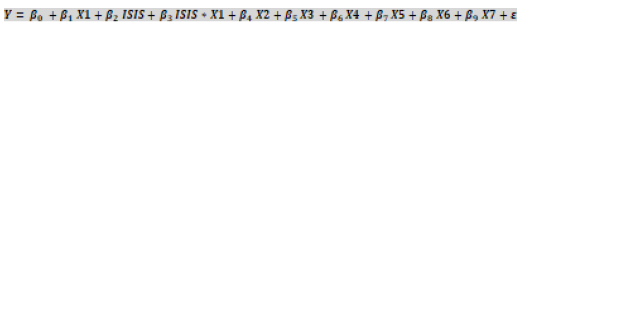

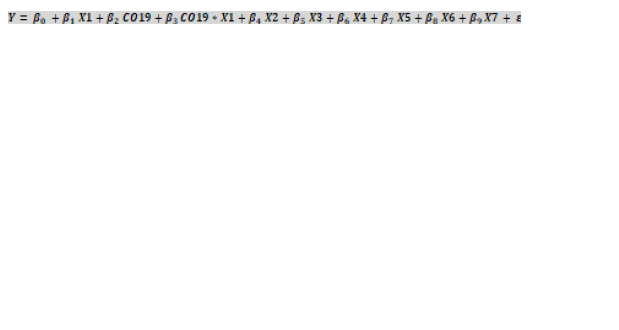

The current study depends on the development of several multiple regression models to study the effect of the independent variable (Iraqi foreign reserves) and the controlling variables (imports, current prices, oil exports, broad money supply, the exported currency and the currency selling window) on the exchange rate, and also to test the effect of the independent variable and the controlling variables In light of the crises (financial (low oil prices), political (war on ISIS) and health (Covid-19)) on the exchange rate, as well as testing the effect of the independent variable and the controlling variables in light of the crises (financial, political and health) and for each crisis separately on the exchange rate. For the purpose of designing regression models, the variables were coded as follows, and as in the table below: (Table 10)

| Expression symbol | variable | Prob. |

|---|---|---|

| Y | exchange rate | 0.033 |

| X1 | Iraqi foreign reserve | 0.023 |

| X2 | imports | 0.047 |

| X3 | current prices | 0.005 |

| X4 | oil exports | 0.018 |

| X5 | Expanded cash offer | 0.032 |

| X6 | issued currency | 0.005 |

| X7 | Currency sell window | 0.039 |

| LOP | Financial crisis (low oil prices) | |

| ISIS | The political crisis (the war on ISIS) | |

| CO19 | Health Crisis (COVID-19) |

To test the hypotheses of the study, and using the symbols in the above table, a set of multiple regression models was designed.

The first model: the model related to testing the first main hypothesis

Testing the first main hypothesis: the role of the Iraqi foreign reserves on the exchange rate (Table 11)

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 1363.421 | 76.160 | 17.902 | 0.000 |

| X1 | -0.001 | 0.003 | -0.411 | 0.689 |

| X2 | 0.009 | 0.004 | 2.218 | 0.051 |

| X3 | -0.001 | 0.001 | -0.797 | 0.444 |

| X4 | 0.001 | 0.003 | 0.316 | 0.758 |

| X5 | 0.003 | 0.006 | 0.452 | 0.661 |

| X6 | 0.004 | 0.011 | 0.378 | 0.713 |

| X7 | -0.014 | 0.005 | -2.812 | 0.018 |

| R-squared | 0.788 | Adjusted R-squared | 0.640 | |

| F-statistic | 5.313 | Prob (F-statistic) | 0.009 | |

| Durbin-Watson stat | 1.595 | |||

Through the results of the statistical analysis in the table above, it is clear that the model is significant, as the value of (Prob) (F-statistic) was less than (0.05), reaching (0.009), which indicates that the model is valid for testing and its results are reliable, while the value of (Durbin- Watson) it amounted to (1.595), which is greater than the value of (R-squared), which amounted to (79%), and this explains the lack of autocorrelation and false regression. As for the value of (R-squared), it amounted to (0.788), which means that the explanatory power of the variables The independent variable of the dependent variable is 79%), while the value of (Adjusted R-squared) was (0.640), which means that the independent variables affect the dependent variable by 64%), while the remaining (36%) is due to other factors outside the model, The results of the statistical analysis show that the value of (Prob) for the independent variable the Iraqi foreign reserve is higher than (0.05), reaching (0.689), which indicates that there is no significant effect of the Iraqi foreign reserve on the exchange rate.

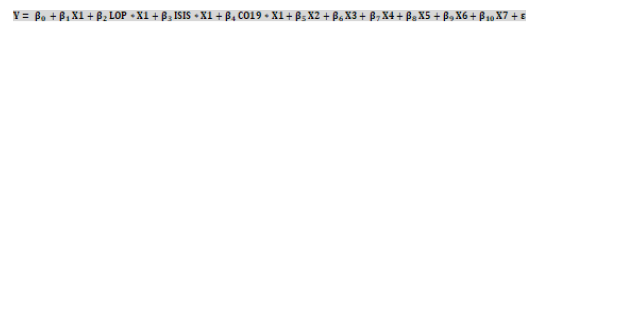

The second model: the model related to testing the second main hypothesis and its branches

Testing the second main hypothesis: the role of the Iraqi foreign reserves on the exchange rate in light of the crises (political, financial, and health). The following hypotheses emerge from them:

- The role of the Iraqi foreign reserves on the exchange rate in light of the financial crisis (low oil prices).

- The role of the Iraqi foreign reserves on the exchange rate in light of the political crisis (the war on ISIS).

- The role of the Iraqi foreign reserves on the exchange rate in light of the health crisis (Covid-19 pandemic) (Table 12).

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 1383.131 | 55.446 | 24.945 | 0.000 |

| X1 | -0.010 | 0.003 | -2.888 | 0.023 |

| LOP*X1 | 0.001 | 0.000 | 2.887 | 0.023 |

| ISIS*X1 | 0.000 | 0.001 | -0.263 | 0.800 |

| CO19*X1 | 0.008 | 0.001 | 5.817 | 0.001 |

| X2 | 0.010 | 0.003 | 3.008 | 0.020 |

| X3 | 0.003 | 0.002 | 2.027 | 0.082 |

| X4 | 0.000 | 0.002 | -0.144 | 0.890 |

| X5 | 0.003 | 0.003 | 1.081 | 0.315 |

| X6 | -0.016 | 0.005 | -3.261 | 0.014 |

| X7 | -0.005 | 0.005 | -1.041 | 0.332 |

| R-squared | 0.938 | Adjusted R-squared | 0.849 | |

| F-statistic | 10.582 | Prob (F-statistic) | 0.003 | |

| Durbin-Watson stat | 2.259 | |||

Through the results of the statistical analysis in the table above, it is clear that the model is significant, as the value of (Prob) (F-statistic) was less than (0.05), reaching (0.003), which indicates that the model is valid for testing and its results are reliable, while the value of (Durbin- Watson) it amounted to (2.259), which is greater than the value of (R-squared), which amounted to (94%), and this explains the lack of autocorrelation and false regression. As for the value of (R-squared), it amounted to (0.938), which means that the explanatory power of the variables The independent variable in the dependent variable is 94%), while the value of (Adjusted R-squared) was (0.849), which means that the independent variables affect the dependent variable by 85%), while the remaining (15%) is due to other factors outside the model.

Interpretation of the result of the first sub-hypothesis of the second main hypothesis:

The results of the statistical analysis show that the value of (Prob) for the independent variable the Iraqi foreign reserves in light of the financial crisis (low oil prices) is less than (0.05), reaching (0.023), which indicates the presence of a significant effect of the Iraqi foreign reserves in light of the financial crisis (low oil prices) oil on the exchange rate.

Interpretation of the result of the second sub-hypothesis of the second main hypothesis:

The results of the statistical analysis show that the value of (Prob) for the independent variable Iraqi foreign reserves in light of the political crisis (the war on ISIS) is higher than (0.05), reaching (0.800), which indicates that there is no significant effect of the Iraqi foreign reserves in light of the political crisis (war On ISIS) on the exchange rate.

Interpretation of the result of the third sub-hypothesis of the second main hypothesis:

The results of the statistical analysis show that the value of (Prob) for the independent variable the Iraqi foreign reserves in light of the health crisis (COVID-19 pandemic) is less than (0.05), reaching (0.001), which indicates the presence of a significant effect of the Iraqi foreign reserves in light of the health crisis (pandemic). COVID-19) on the exchange rate.

The third model: the model related to testing the first sub-hypothesis of the second main hypothesis

Testing the first sub-hypothesis of the second main hypothesis: the role of the Iraqi foreign reserves on the exchange rate in light of the financial crisis (low oil prices) (Table 13).

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 1034.063 | 104.949 | 9.853 | 0.000 |

| X1 | 0.004 | 0.005 | 0.743 | 0.479 |

| LOP | 399.936 | 116.247 | 3.440 | 0.009 |

| LOP*X1 | -0.005 | 0.001 | -3.520 | 0.008 |

| X2 | 0.006 | 0.004 | 1.575 | 0.154 |

| X3 | -0.002 | 0.001 | -1.760 | 0.117 |

| X4 | 0.003 | 0.003 | 0.915 | 0.387 |

| X5 | 0.003 | 0.005 | 0.586 | 0.574 |

| X6 | 0.005 | 0.010 | 0.467 | 0.653 |

| X7 | -0.010 | 0.007 | -1.455 | 0.184 |

| R-squared | 0.860 | Adjusted R-squared | 0.702 | |

| F-statistic | 5.453 | Prob (F-statistic) | 0.013 | |

| Durbin-Watson stat | 2.309 | |||

Through the results of the statistical analysis in the table above, it is clear that the model is significant, as the value of (Prob) (F-statistic) was less than (0.05), reaching (0.013), which indicates that the model is valid for testing and its results are reliable, while the value of (Durbin- Watson) it amounted to (2.309), which is greater than the value of (R-squared), which amounted to (86%), and this explains the lack of autocorrelation and false regression. As for the value of (R-squared), it amounted to (0.860), which means that the explanatory power of the variables The independent variable in the dependent variable is 86%), while the value of (Adjusted R-squared) was (0.702), which means that the independent variables affect the dependent variable by 70%), while the remaining (30%) is due to other factors outside the model, and the results show Statistical analysis showed that the value of (Prob) for the independent variable the Iraqi foreign reserves in light of the financial crisis (low oil prices) is less than (0.05), reaching (0.008), which indicates a significant effect of the Iraqi foreign reserves in light of the financial crisis (low oil prices). on the exchange rate.

Fourth Form: The form related to testing the second sub-hypothesis of the second main hypothesis

Testing the second sub-hypothesis of the second main hypothesis: the role of the Iraqi foreign reserves on the exchange rate in light of the political crisis (the war on ISIS) (Table 14).

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 1536.784 | 125.617 | 12.234 | 0.000 |

| X1 | -0.011 | 0.006 | -1.848 | 0.107 |

| ISIS | -867.707 | 308.097 | -2.816 | 0.026 |

| ISIS*X1 | 0.009 | 0.004 | 2.564 | 0.037 |

| X2 | -0.004 | 0.007 | -0.538 | 0.608 |

| X3 | 0.002 | 0.002 | 1.008 | 0.347 |

| X4 | -0.001 | 0.003 | -0.270 | 0.795 |

| X5 | 0.003 | 0.005 | 0.573 | 0.585 |

| X6 | 0.005 | 0.009 | 0.536 | 0.608 |

| X7 | -0.003 | 0.009 | -0.351 | 0.736 |

| R-squared | 0.852 | Adjusted R-squared | 0.662 | |

| F-statistic | 4.481 | Prob (F-statistic) | 0.030 | |

| Durbin-Watson stat | 1.754 | |||

Through the results of the statistical analysis in the table above, it is clear that the model is significant, as the value of (Prob) (F-statistic) was less than (0.05), reaching (0.030), which indicates that the model is valid for testing and its results are reliable, while the value of (Durbin- Watson) it amounted to (1.754), which is greater than the value of (R-squared), which amounted to (85%), and this explains the lack of autocorrelation and false regression. As for the value of (R-squared), it amounted to (0.852), which means that the explanatory power of the variables The independent variable in the dependent variable is 85%), while the value of (Adjusted R-squared) was (0.662), which means that the independent variables affect the dependent variable by 66%), while the remaining (34%) is due to other factors outside the model, and the results show Statistical analysis showed that the value of (Prob) for the independent variable the Iraqi foreign reserves in light of the political crisis (the war on ISIS) is less than (0.05), reaching (0.037), which indicates the presence of a significant effect of the Iraqi foreign reserves in light of the political crisis (the war on ISIS) on the exchange rate.

The fifth model: the model related to testing the third sub-hypothesis of the second main hypothesis

Testing the third sub-hypothesis of the second main hypothesis: the role of the Iraqi foreign reserves on the exchange rate in light of the health crisis (Covid-19 pandemic) (Table 15).

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 1408.669 | 45.173 | 31.184 | 0.000 |

| X1 | -0.010 | 0.003 | -2.881 | 0.021 |

| CO19 | 1781.304 | 273.828 | 6.505 | 0.000 |

| CO19*X1 | -0.013 | 0.003 | -3.710 | 0.006 |

| X2 | 0.008 | 0.003 | 2.559 | 0.034 |

| X3 | 0.005 | 0.001 | 3.881 | 0.005 |

| X4 | -0.002 | 0.003 | -0.887 | 0.401 |

| X5 | 0.001 | 0.003 | 0.370 | 0.721 |

| X6 | -0.015 | 0.005 | -2.813 | 0.023 |

| X7 | -0.007 | 0.004 | -1.752 | 0.118 |

| R-squared | 0.949 | Adjusted R-squared | 0.892 | |

| F-statistic | 16.543 | Prob (F-statistic) | 0.000 | |

| Durbin-Watson stat | 2.401 | |||

Through the results of the statistical analysis in the table above, it is clear that the model is significant, as the value of (Prob) (F-statistic) was less than (0.05), reaching (0.000), which indicates that the model is valid for testing and its results are reliable, while the value of (Durbin- Watson) it amounted to (2.401), which is greater than the value of (R-squared), which amounted to (95%), and this explains the lack of autocorrelation and false regression. As for the value of (R-squared), it amounted to (0.949), which means that the explanatory power of the variables The independent variable in the dependent variable is 95%), while the value of (Adjusted R-squared) was (0.892), which means that the independent variables affect the dependent variable by 89%), while the remaining (11%) is due to other factors outside the model, and the results show Statistical analysis showed that the value of (Prob) for the independent variable the Iraqi foreign reserves in light of the health crisis (COVID-19 pandemic) is less than (0.05), as it reached (0.006), which indicates the presence of a significant effect of the Iraqi foreign reserves in light of the health crisis (COVID-19 pandemic). 19) on the exchange rate.

Conclusions

1. Imports affect the volume of foreign reserves because Iraq is a nonproductive country of goods and services, and foreign reserves covered the volume of imports for three months over the study years (2004-2021).

2. It did not exceed the specific percentage set by the International Monetary Fund to cover the volume of foreign reserves relative to the gross domestic product at current prices during the years of the study, as the arithmetic mean was (32%), which is less than the natural percentage (20%-40%).

3. There is a direct relationship between crude oil exports and the foreign reserves owned by the Central Bank, where the higher the oil exports, the greater the foreign reserve balance with the Central Bank of Iraq.

4. The foreign reserve balance is important to face the shocks and crises to which the value of the national currency is exposed, as there is a direct relationship between the volume of foreign reserves and the wide money supply m2, and the optimal size for that ratio is (10-20%) in Iraq, as it follows a fixed monetary system, and it ranged The percentage during the years (2004-2021) ranged between (66-169%).

5. Exceeding the specified and natural ratio of (100%) between foreign reserves and the exported currency during the study years (2004-2021), as it ranged from (116-276%). This indicates that there is a margin of safety and confidence in the national currency and preventing its collapse easily.

6. Imports deplete a large volume in the sales of the Central Bank of Iraq through the study years extending from (2004-2021) we note that in the year (2013) the sales of the foreign currency sale window amounted to (53,231) fifty-three thousand two hundred and thirty-one billion dollars, due to The increase in the volume of imports, which is shown in Table No.

(8), where imports were recorded in the same year (49,977) forty-nine, nine hundred and seventy-seventy billion dollars, which indicates an inverse relationship between foreign reserves and the volume of imports due to the increase in unnecessary expenditures.

7. The study data stability tests according to the expanded test used (Dickie Fuller) showed that all time series data in the study for the period (2004- 2021) are stable over time because the probability values of the study variables are less than (0.05).

8. The results of the statistical analysis of the foreign reserve variable (independent) showed that it was higher than (0.05), reaching (0.689), which indicates that there is no significant effect (for the Iraqi foreign reserve) on the dependent variable (exchange rate).

9. The result of the statistical analysis of the first sub-hypothesis of the second main hypothesis according to the second and third models proved that there is a significant impact of the Iraqi foreign reserves in light of the financial crisis (low oil prices) on the exchange rate, where the value of (prob) was less than (0.05) and it was (0.023). ) and (0.008).

10. It was found from the results of the interpretation of the second subhypothesis of the second main hypothesis according to the second model that there is no significant effect of the Iraqi foreign reserves in light of the political crisis (the war against ISIS) on the exchange rate, as the value of (prob) was higher than (0.05) and it witnessed (0.800). And the fourth model indicated that there is a significant impact of foreign reserves in light of the political crisis and the war against ISIS, and it reached (prob) (0.037), which is less than (0.05).

11. There is a significant impact of the Iraqi foreign reserves in light of the health crisis (covid-19) on the exchange rate, as the value of (prob) reached (0.001) and (0.006), which is less than (0.05) according to the second and fifth models.

Recommendations

Through what has been presented of the results related to the theoretical and practical side (applied) of the study, we briefly mention the most important recommendations that it is hoped will be under the eyes of the beneficiaries and those concerned with this, to take into account the service for the benefit of the Iraqi economy and the development of productive sectors.

1. Diversifying foreign reserves in a way that guarantees investment in them and not leaving them in a way that costs preserving them for their safety in the face of possible shocks.

2. Diversifying the sources of obtaining foreign currency and not being limited to what Iraq gets from the oil, because the oil sector is exposed to fluctuations and shocks globally, which affects the selling prices of oil and thus reduces the value of the accumulated foreign reserves and affects the exchange rate, which leads to instability financial.

3. Raising the efficiency of the industrial, agricultural and service production sectors and achieving sufficiency in Iraq to work side by side with the oil sector to supplement the balance of foreign reserves.

4. Encouraging the export of agricultural and industrial products abroad with the aim of obtaining foreign currencies to increase foreign reserves.

5. Reducing the value of unnecessary imports, as they deplete the value of hard currency and losing it abroad, and work to direct foreign reserves and invest them in important and useful sectors such as education, industry, agriculture, and health, which are among the dilapidated infrastructures.

6. Establishing new mechanisms to work within the currency sale window to limit the flight of hard currencies abroad due to unnecessary spending through imports of consumed and useless goods and products.

7. The necessity of having controls and mechanisms for the purpose of transferring the currency abroad and limiting it to what is necessary, and verifying this in order not to neglect it, deplete it and escape abroad.

References

Abu Nab, E. (2019). “Women’s fashion consumption in Saudi Arabia”. PhD. Thesis. De Montfort University. Leicester.

Al-Rashoud, S; Nafie, Saeed A; & Abu Farraj, A (2018). The culture of consumption among the Saudi family (a field study). Arab Journal of Educational and Social Studies. (12), 53-164.

Al-Zahrani, N (2017). The Saudi family's achievement of the concept of sustainable consumption: a field study applied to a sample of Saudi families. um Al-Qura University Journal of Social Sciences. 10(1): 117-199.

Bahauddin, F. (2020). The personality traits of the head of household and their relationship to consumer behavior, Egyptian Journal of Specialized Studies, 8(26), 19-68.

Bani-Rshaid, A. & Alghraibeh, A.(2017). Relationship between compulsive buying and depressive symptoms among males and females. Journal of Obsessive-Compulsive and Related Disorders, 14, 47-50.

Bögenhold, D. & Naz, F. (2018). Consumption and life-styles: A short introduction. Palgrave Macmillan. Cham.

Brown, J. & Brown, C. (2002). Marital therapy: Concepts and skills for affective practice. Thomson learning: books/cole.

Bukhari, A (2021). Phenotypic Consumption of Luxury Goods in the Kingdom of Saudi Arabia: An Applied Study on the City of Jeddah, Journal of Economic, Administrative and Legal Sciences, National Research Center, Gaza, 1-24.

Chaudhuri, H. & Majumdar, S. (2010). Conspicuous consumption: Is that all bad? Investigating the alternative paradigm. Vikalpa. 35 (4): 53-59.

Cohen, Y., Ornoy, H., & Keren, B. (2013). MBTI personality types of project managers and their success: A field survey. Project Management Journal, 44(3), 78-87.

Decimal pointing. (2018). Returning migration and the transformation of consumption patterns among the middle class segments, "A field study in Tanta City", Journal of the Faculty of Arts, Faculty of Arts, Alexandria University, 68(94), 1-47.

Dialogist, S. (2017). Predictive ability of the degree of similarity in personality traits and forms of communication between spouses in family compatibility among a sample of couples, Master Thesis, Yarmouk University, Faculty of Education, Jordan, 1-149.

Good, N. (2022). Personality styles as a mediating variable in the relationship between quality of career life and ethical behavior: An applied study on employees of the General Authority for Educational Buildings, Scientific Journal of Economics and Trade, Ain Shams University, Faculty of Business, (4), 409-438.

Jain, A. & Sharma, R. (2018). Understanding of the term conspicuous consumption: A literature review. International Journal of Management and Applied Science. 4 (1): 33-34.

Khalifa, M.(2018). Identifying the personality pattern prevailing among male and female students in the two faculties of education in the State of Kuwait, Journal of the Faculty of Education, Tanta University, Faculty of Education, 69(1), 314-343.

Khamshi, J (2017). Raising the awareness of Saudi women in rationalizing spending and developing savings methods. Conference on Enhancing the Role of Saudi Women in Community Development in Light of the Kingdom's Vision 2030. 24-25 ABrill. Riyadh.

Kiosk, T. (2018). E-shopping and its role in spreading the culture of consumption: a descriptive study applied in the port city, Journal of the Faculty of Arts and Humanities, Suez Canal University, Faculty of Arts and Humanities, Egypt, (25), 68-121.

Klabi, F. (2020). To what extent do conspicuous consumption and status consumption reinforce the effect of self-image congruence on emotional brand attachment? Evidence from the Kingdom of Saudi Arabia. Journal of Marketing Analytics. 8: 99-117.

Lissitsa, S., & Kol, O. (2021). Four generational cohorts and hedonic m-shopping: association between personality traits and purchase intention. Electronic Commerce Research, 21, 545-570.

Lixăndroiu, R., Cazan, A. M., & Maican, C. (2021). An analysis of the impact of personality traits towards augmented reality in online shopping. Symmetry, 13(3), 416.

Malki, R. (2020).The Impact of Entertainment on the Value System of the Saudi Family: A Field Study on Some Families of Jeddah City, International Journal of Educational and Psychological Sciences, (54), 107-177.

Memushi, A. (2013). Conspicuous Consumption of luxury goods: Literature review of theoretical and empirical evidences. International Journal of Scientific & Engineering Research. 4 (12): 250-255.

Muhammad, A; Al-Zuhri, F; Ali, S. (2022). Women's Life Management Skills and Their Relationship to Family Compatibility, Southern Dialogue journal, Assiut University, Faculty of Specific Education, (14), April, 125-173.

Rabee, M(2013). Personal Psychology, Amman: Dar Al- Masirah.

Roy Chaudhuri, H., Mazumdar, S., & Ghoshal, A. (2011). Conspicuous consumption orientation: Conceptualization, scale development and validation. Journal of Consumer Behavior, 10(4), 216-224.

Sahaf, I. (2015). Marital compatibility and its relationship to family stability among a sample of married couples in the city of Makkah, unpublished master's thesis, College of Education, Department of Psychology, um Al-Qura University, Saudi Arabia.

Sarah. S (2016). Compulsive Purchase and its Relationship to Self-Esteem among a Sample of University Students, Journal of Arab Studies, Egyptian Association of Psychologists, Egypt, 15(1-19).

Sharifeen, A; (201)8). Building a Personality Patterns Scale According to Yoon G's Theory, Journal of Educational and Psychological Sciences, University of Bahrain-Scientific Publishing Center, 19(4), 315-354.

Starkey, J. L. (1991). Wives' earnings and marital instability: Another look at the independence effect. The Social Science Journal, 28(4), 501-521.

Tashtosh, R. (2022). Personality Patterns and their Relationship to Decision Making among Educational Counselors in Jordan, Mutah Journal for Research and Studies, Humanities and Social Sciences Series, Mutah University, 37(4), 137-176.

Toth,M.( 2014). the role of self –concept in consumer behavior,A thesis submitted in partial fulfillment of the requirements for the Master of Arts - Journalism and Media Studies, Hank Greenspun School of Journalism and Media Studies, Greenspun College of Urban Affairs. The Graduate College, University of Nevada, Las Vegas.

Truong, Y.; Simmons, G.; McColl, R.; & Kitchen, P. (2018). Status and Conspicuousness -Are they related? Strategic marketing implications for luxury brands. Journal of Strategic Marketing. 16 (3): 189-203.

Wang, J. & Foosiri, P. (2018). Factors related to consumer behavior on luxury goods purchasing in China. UTCC International Journal of Business and Economics. 10 (1): 19-36.

Wood, S. (2012). Prone to progress: Using personality to identify supporters of innovative social entrepreneurship. Journal of Public Policy & Marketing, 31(1), 129-141.

World Gold Council. (2019) . Gold demand trends full year and Q4 2019”. Available from; https://www.gold.org/ goldhub /research/gold-demand-trends.

Yusuf, G. O., Sukati, I., & Andenyang, I. (2016). Internal marketing practices and customer orientation of employees in Nigeria banking sector. International review of management and marketing, 6(4), 217-223.

Zhang, C., Brook, J. S., Leukefeld, C. G., De La Rosa, M., & Brook, D. W. (2017). Compulsive buying and quality of life: An estimate of the monetary cost of compulsive buying among adults in early midlife. Psychiatry research, 252, 208-214.

Zoukar, Z (2013). Introduction to Personal psychology and mental health, 1st ed., Markaz aleshaa alfekri for Studies and Research, Palestine,