Full Length Research Article - (2023) Volume 18, Issue 5

The Role of the Psychology of Lean Accounting Principles in Enhancing the Reliability of Financial Statements

Omar Kaysar Abdulamir1* and Jamel Chouaibi2*Correspondence: Omar Kaysar Abdulamir, PhD Candidate at Institute of Higher Commercial Studies in Sousse, University of Sousse, Tunisia, Email:

Abstract

There are many problems in operations that cannot be found in the financial statements, despite the significant improvement in cash flows. Because of these and other problems, traditional methods in management accounting systems have become useless. As the traditional accounting systems created many distortions in the reliability of the financial statements that could impede the progress in the business, which required the auditors to adopt the principles of lean accounting in order to enhance the reliability of the financial statements. The current research aims to demonstrate the effect of using lean accounting principles by the auditor in enhancing the reliability of the financial statements in the auditors' offices in Iraq. The researchers translated the goal of the research into a hypothetical model that includes the variables, dimensions and hypotheses of the research according to the analytical curriculum in the auditors' offices. Then several hypotheses were formulated and tested using the appropriate statistical methods and using the statistical package program (SPSS) and (Amos) to prove the validity of the research hypotheses related to the correlation and influence between the two research variables using the multiple regression coefficient and the correlation coefficient. Workers in auditors’ offices in Iraq represented the research community. The sample size was determined by (208) individuals. The research also reached a set of conclusions, the most important of which is the existence of a correlation between the principles of lean accounting and the reliability of the financial statements in the auditors' offices in Iraq. Based on the conclusions that the research included, the researcher presented some recommendations, the most important of which is giving more attention and focus by officials in the auditors' offices to the principles of lean accounting and its methods of application, as it is one of the contemporary accounting issues.

Keywords

Auditor. Lean accounting principles. Reliability of financial statements

Introduction

Lean accounting principles are one of the lean methods used in the lean approach, and adopted by the leading American and European companies, through which the auditor can achieve positive results and a high degree of reliability in the financial and accounting statements by providing statements that are characterized by outward representation, impartiality, and focus on the essence of information In addition to caution and caution in providing this information in an integrated manner (Al-Taee & Flayyih, 2023; Flayyih, 2016). The task of the auditor is to express an opinion on the financial statements of the enterprise (financial position, income statement, cash flows, and changes in equity), and the opinion may be clean, conservative, unclean, or the inability to express an opinion (M. A. Ali et al., 2023; Hadi, Ali, et al., 2023). In order for the auditor to be able to form his opinion, he must carry out audit tasks and procedures that help him reach the formation of the appropriate opinion. Among these methods is the examination of the internal system and the control system, and conducting substantial tests, compliance tests, and so on. Therefore, adopting lean accounting principles represented in planning from an agile perspective, then shifting practices, delivering information in a timely manner, as well as monitoring lean accounting procedures and processes, can strengthen these tasks. In order to produce reliable financial statements from the beneficiary parties (Abass et al., 2020).There are many problems in operations that cannot be found in the financial statements, although cash flows have improved greatly. Because of these and other problems, the traditional methods of management accounting systems have become useless. As traditional accounting systems have created many distortions in financial reporting that can hinder progress in agile business, to sustain the lean transformation, auditors must know how to adopt lean accounting principles and transform routine accounting practices into a new system to support lean practices. Therefore, it has become necessary for those working in auditors' offices in Iraq to improve the quality and reliability of the financial statements they produce. In light of the foregoing, the research problem crystallizes in stating the effect of using lean accounting principles by the auditor in enhancing the reliability of the financial statements in the auditors' offices in Iraq, so the research problem is reflected through the questions: Is there a relationship between the auditor and the reliability of the financial data in the field research sample? Is there a relationship between the auditor and the principles of lean accounting in the field of the research sample? Is there a relationship between the principles of lean accounting and the reliability of financial statements in the field research sample? Do the principles of lean accounting influence the relationship between the auditor and the reliability of the financial statements in the field of the research sample? Starting with the importance and role of the variables under study, which derived their importance from the field problem that it addresses, as the study focused on important variables represented (Comptroller, Lean Accounting Principles, and Reliability of Financial Statements), As important variables in the accounting literature, and their study contributes to the benefit of the auditors' offices, especially in defining the impact of these variables on their work and the quality and reliability of the financial statements. The importance of the research stems from being a descriptive and analytical study based on the adoption of the field study of the opinions of the sample members, and that the offices of the study sample need such studies. As it provides them with information about capabilities that can be employed in the service of exploiting their energies in a more effective and efficient manner, especially in the Iraqi environment that was covered by the study. The study provides a practical framework for drawing features of a contemporary model in decision-making, which could be a pioneering attempt for members of senior management in the auditors' offices to make a decision that suits the nature of the challenges they face in the Iraqi environment in terms of adaptation and speed.

Theoretical review

Concept of auditor:

The auditor is defined as the person responsible for auditing and reviewing the books and records of the company at specific periods, with the aim of detecting accounting manipulations, preparing reports on fraud and forgery, and expressing an opinion on the accounting situation that the company is going through (Ali et al., 2023; Maseer et al., 2022). The auditor must study the internal control systems accurately and properly and develop an audit program commensurate with the work entrusted to him in addition to his request for evidence to verify the balances shown in the financial statements and not to rely entirely on the internal control systems because the examination and study of these systems reduces the possibility of occurrence Manipulation and fraud, but it does not prevent it, in addition to the management's responsibility for the existence of errors, manipulation and fraud in the financial statements (Alkhafaji et al., 2018), given that it is the duty of the administration to take control, accounting and administrative measures to ensure the protection of its assets, and on this basis, it is the duty of the auditor to plan his work and develop a program for audit procedures and how to implement them through his assistants (John, 2019: 219).An auditor or auditor can be defined as someone who regularly reviews payment processes in institutions, organizations and authorities. He checks accounting documents, annual accounts, budget statements and fund accounts, as he reviews the correctness and completeness of recording daily business operations as well as accounting accounts and restrictions to obtain results for the year, quarter or month.

(Gillan et al, 2007: 930). In addition, he audits the management of funds, debts, and the use of financial and in-kind materials. One of his tasks is also to audit the use of financial resources for an economically feasible use, for example, in the case of making forms. Accounts at all times review all the documents necessary for his work, prepare a written report after conducting the audit and provide the management of the institution or the representatives of the owners or members of the supervisory board with information about the results, as it alerts primarily to the existing defects and possibilities for improvement (Philip et al, 2007: 208). The auditor is defined as the person who audits the accounts and submits a report on the results of his audit impartially and independently (Carolyn & Bent, 2009: 45). We conclude that there should be certain qualifications and characteristics available in the person in order to become an auditor in the fullest sense and to have a role in the institution where by dismissing him several things are clarified, including the quality of internal control, strong or weak. Internal control is considered the starting point for the auditor's duties, and the basis on which he relies when preparing the audit program, determining the extent of the tests that he will perform and knowing which control system he will operate. The importance of the auditor's role in giving credibility to the financial statements of companies in light of the increasing importance of this data requires attention to this profession by those in charge of it, as it requires work to re-consider the professionalism of auditing, and that is by focusing on the quality of the auditing process and the factors that contribute to its increase (Abass et al., 2023), the importance of the auditor lies through the knowledge of all misleading accounting practices that the accountant may adopt under the guidance of the management and following appropriate mechanisms to reduce those practices that lead to manipulation and fraud in financial reports while reviewing the applied accounting policies and management estimates, including He achieves the objectives of the company and thus reaches reliable financial reports free of fraud and misleading so that he can express a neutral technical opinion on the fairness of the financial statements (Hadi et al., 2023). Accounting is called the language of business, as it adapts and communicates with the changes and developments that occur in various areas of life, as it communicates transparent and reliable financial information about the economic unit to multiple parties for making economic decisions by them (Flayyih, 2015). However, manipulation or deception that may occur with accounting data by some accountants (Hasan et al., 2023; Nikkeh et al., 2022), based on the management’s desire at the expense of the establishment, has contributed in one way or another to the decline of the accounting profession (Muhammad and Attia, 2020: 49). Where the auditor seeks to achieve the maximum degree of independence and impartiality when performing the work of auditing operations(AL-Timemi & Flayyih, 2013).The emergence of assurance services represents an important developmental stage in the profession of account auditing, as the auditor shifted from his traditional role in examining or auditing information or lists prepared in advance with a specific financial formula to granting a certificate of assurance in the preparation of this information or financial and even nonfinancial statements, and this certificate (The report) is distinguished by some privacy from the conventional audit report. Assurance services lie between the level of applied assurance and the absence of assurance, and it contains a wide range of services that do not deviate from the two types of reasonable assurance and limited assurance. Specialized professional organizations, including AICPA, have issued a set of Standards for these services to rationalize their practical application (Al-Shammari et al., 2017).

Agile accounting

Lean Accounting, or as it is called Lean Accounting, is part of an integrated system and management style (Lean Management System). Non-Value Work and thus make production processes easier, simpler, more efficient, effective, and more capable of understanding and implementation (Daniel Haskin, 2010: 288). A lot of ambiguity has accompanied the term lean accounting for most businesspersons and accountants at the beginning of its appearance. They have heard about lean manufacturing, but not lean accounting. The reason for this ambiguity is how to introduce lean ideas into accounting and financial processes. Lean accounting deals with productivity or revenue and the variable costs associated with it that are necessary to generate sales, and its idea is “do not spend money unless it is related to generating profits.” Since lean accounting provides better information for decision-making, it has an effect on increasing sales, which is especially important in light of slow economy, as organizations need tools such as value stream costing and similar agile decision-making applications (Kateryna Ogar et al, 2017: 49). Lean accounting is a term associated with accounting and financial operations and refers to practical and simplified accounting practices designed to provide business leaders with easy-to-understand figures. (Garrison, 2010: 325) defined lean accounting as an accounting system for managing the organization's financial operations with the aim of providing the relevant financial and non-financial information needed to implement the lean strategy and lead to financial success (Flayyih & Khiari, 2023). Known (ED. STANZEL, 2007: 290) The Lean accounting is that it is a financial learning system for the entire organization, and not only the accounting function, given that the Lean economies change the relations between operations and financial numbers, and the entire organization must learn the new relations and integrate the dynamic context of these relations in its financial analysis. The organizations use their administrative accounting system to align the organization's strategy with its business model for operating practices by providing relevant data for all levels of management to make decisions and financial analysis. And (Shuja, 2015: 11) defined it as an organized working method based on tools and technologies used for the purpose of reducing waste and loss in financial resources, and human efforts, and then it contributes to providing valuable information to the company that enables it to compete in the markets, which leads to reducing costs. (Hansen et al, 2009: 577) pointed to the concept of Lean accounting as a set of principles, practices and tools that support the Lean production system and focus on continuous improvement within the economic unit and on cost management instead of focusing on accounting traditional costs that distort the costs of product and improvement efforts Continuous. And (Al -Masoudi and Al -Kaisar, 2016: 116) knew it It is a set of operations that seek to analyze the company's activities in order to activate and remove all activities that do not add value to the company in order to remove waste and add value to the customer. Based on the above concepts, the researcher strives to provide a concept of Lean accounting as a "approach to the management of mathematical and financial operations through routine technicians, reduce traditional processes and provide information to beneficiaries with the aim of making appropriate decisions, reducing time, cost and getting rid of waste by getting rid of unnecessary processes that which Do not narrow any value".

Gathering accounting depends on a number of principles that focus on the architecture and simplification of accounting processes in business, stimulate long -term improvements through information and measurements that focus on fitness, and define expected financial benefits from applying Lean thought and focusing on strategies that achieve these benefits (Monroy et al, 2013: 30). Each of the form of each of (Maskell & Baggaley, 2006: 36) in determining the principles of Lean accounting in the context of the following paragraphs: Planning from the agility perspective: Steeling is planned using a set of tools, including sales policy, financial and operational planning, value of value and energy analysis, and this process leads to the organization of an integrated plan for the organization using Lean accounting information. The financial impact is the true effect of improving candidacy, as it should be understood since the start of any transformation of rating by using the current situation and the future situation, and when the start of the transformation process for rash is to stop thinking about improving production and reducing costs in the short term and is prevalent in the case of great production (WEMPE, 2011: 53). The Lean perspective is planned by using some Lean accounting tools such as financial and operational planning, value of value and sales policy, where an integrated plan for the organization or company is organized (Kateryna OGAR ET Al, 2017: 43). Supporting the transformation to fitness: accounting processes that support Lean transformations include: measuring visual performance, continuous improvement, calculating the cost of the value of the value, the target cost, and communicating information clearly and in time, when the organization is committed to a simple strategy, the basics of how the organization works will change with the application Gathering practices, how the work is controlled, what should be measured and the relevant information for work decisions will be different from "before grace", and the internal financial reports, financial analysis, measurements and data used to control business and decision -making standards should be supported (Baggaley, 2007: 37). The Lean accounting supports the process of rating in the production system of economic units, by preparing reports that reflect the financial and operational performance of the flow of value, focus on measuring and understanding the creation of value for the customer, and using information that enhances the customer's relationship, product design and pricing (Daniel, 2010: 18). Delivery of information in a timely manner: The administration uses visual management panels accompanying the tools of the points fund that displays the financial and operational performance in a unified report and this performance is widely used in decision -making in addition to using a simple and clear income detection and work to exclude all mysterious and shaded data for the purpose of support and support This principle (Blocher et al, 2010: 773). What is meant by this principle is to provide clear information for all, whether inside or outside the company, so that information is provided in a clear language without there being complications in communicating information. Likewise, this information must be connected in time to help make decisions in a timely manner, and the administration here uses the visual performance panels accompanying the point’s fund that displays financial performance and operating in a unified report to help make decision -making. Promoting accounting censorship: There are several controls to support and ensure Lean accounting changes such as (Sarbanes Oxley), as this method is used to improve projects, reduce risks, and enhance internal control (Maheshwari et al, 2009: 310: 310: This principle depends on the application of Lean methods on accounting processes, as most accounting processes contain lost (MUDA) and thus use some tools, to eliminate lost or waste, and the Lean accounting tools used to eliminate waste are accurate and applied to both control, and measurement. Where this principle uses some tools until the rating is applied to operations, and among those tools is the map of the Value Stream Map, the target cost, the Kaizen style, and the score box (Stenzel, 2007: 40).

Reliability of financial statements

The reliability of the financial statements means that the financial statements are free of important and stand -up mistakes and can be relied upon by users as information that is honestly represented by operations and events or it is expected that future events are reasonable to be reasonably based on three basic elements are neutral, justice, representation and susceptibility to verification (AFOLABI, 2017: 209). indicated (Adebayo et al, 2016: 241) that the reliability of the financial statements means that the information is accurately represented by what it should represent far from any bias and is not affected by the personal provisions of those in charge of its preparation. Reliability means the financial statements that can be relied upon by its beneficiaries, especially decision makers (IASB, 2018: 51). The reliability means that the financial statements are useful and important if the accountant is possible to rely on it as a measure of the economic events and conditions that it represents, especially if this information has a degree of objectivity represented in the lack of bias and free of deviations, errors and honesty in the numbers of this information (Iyoha, 2012: 42). Financial statements are data organized based on logical procedures and aims to transfer information about most of the financial components of business companies, and information may appear on a certain moment, or may contribute to clarifying a set of financial operations within a certain period (Dogan et Al, 2017: 228). (Efobi, 2014: 317) indicated that the financial statements are a set of financial statements for a company, and often contains information on income, cash flows, the public budget, and profits, and these lists are among the activities that all companies apply. By relying on the use of accounting principles. Financial statements are defined as reports that contribute to clarifying the financial status of the company during some time, or a specific period. The reliability of the financial statements is the procedures that must be followed to make the information reliable by the stakeholders in general and decision makers in particular, and to persuade them to have their pleasure (Vrentzou, 2017: 338). The reliability of the financial data can be defined as (data ability to reflect the actual reality of the company, and management can benefit from that data with confidence). Financial reports aim to meet the needs of decision makers, and accordingly the timing is determined as one of the information characteristics in financial reports to achieve this goal, financial reports must be available on time to inform decision -making and then financial reports must be published as soon as possible after the end The accounting period, the benefit of the financial statements is not valid if it is not available to users within a reasonable period after the date of the report (Sevin, 2017: 674). The reliability of the financial statements in this study was determined by what (Tontiset & Kaiwinit, 2018: 294), so we try through the current topic to identify the main pillars of the reliability of financial statements, by focusing on completion, caution, neutrality, quality of information Sincere representation, within the framework of the following paragraphs: Completeness: In order for the information to be reliable, attention must be paid to its essence and its reality and not only its legal form, there is no benefit from information that coincides with its legal form with legal presentation forms, but at the same time it is not represented in reality far from the truth, and examples of this are many such as the classification of investments is The structure of the facility is linked to considering it as a trafficking (Available for Sale Investments), its display in the budget must be identical with the intention of the facility to classify it, as well as the matter for invested property, or mutual operations between the relevant parties (Liou, 2018 : 41). Caution and caution: They are those that represent the buildings and cannot be validated, but it is the basis of the intellectual framework, valid to reach the results of accounting and infer them, just as the assumptions are the basic assumptions used to derive the principles of accounting and preparation of data, and it is possible to determine the assumption that it is the one who gives the basis The first through conclusion training, the hedging principle is one of the accounting principles (Kamran, 2013: 20). Caution and caution indicate the necessity of taking all the expenses and losses that are possible to take into account when determining the outcome of the financial position of the facility and its work, and in return, not to recognize the expected and possible profits and revenues to occur, and to recognize the profits and revenues only achieved. The use of this principle by companies and institutions is a clear protection from the effects of inflation, which has now become a monster in the past ten years. Accounting societies resorted to this principle in the early seventies, especially after the oil crisis, which forced states to deviate from the base of gold and go to the current value (Kaminski et al, 2014: 59). Neutrality: It means avoiding bias (free from biaas) and the information included in the financial statements is also if it is prepared for public use regardless of the interests of any of the stakeholders, as well as the information is neutral if it is processed away from any pre -assumption (Abdullah et al, 2015: 32). The possibility of verifying and verifying information means in the accounting concept that provides the condition of objectivity in any scientific measurement, and this characteristic means that the results reached by a specific person using certain methods of measurement and disclosure can reach another using the same methods, while the possibility of verifying the information is a feature that achieves us Avoid this type of biology related to the personality of the operation, that is, the distinction between the ability to verify the same standards and the ability to verify the validity of the application to the measurement method (Adediran et al, 2013: 115). Quality of information: It means that the information presented in the financial statements must be complete, not deficient in not deleting or canceling any part of it, whether through financial statements or through explanatory notes, for example, the owners' investments and their withdrawals must be disclosed through notes, Likewise, disclosure of the information of non -circulating assets, methods of destruction, financial investments and how to evaluate them (Berger, 2011: 208). Sincere representation: It relates to sincere representation the risks of notice associated with the terms of financial data, which thus leads to non -recognition, and this reduces the extent of commitment as sincere representation, as it is in terms of lack of recognition of these items agreed with the sincere representation to not verify their achievement and values and the possibility Its measurement, and therefore, it does not rise to the degree of sincere representation, and on the other hand, the lack of display also does not agree with the sincere representation, since sincere representation requires that the information that affects the center, financial performance and cash flows are displayed even if this is linked to some factors of disturbance, and compatibility can be achieved And the balance between the two aspects by disclosure and a fair presentation of items, in which the characteristic of honest representation is not available within the notes attached to the financial statements (Biddle et al, 2009: 118). It means that the financial information is represented by the sincerity of the operations and financial events that occurred in the facility, which was expressed in the financial statements. The list of the financial center represents the fairness of the financial position of the facility. Income expresses the result of the company's business and financial performance, and the list of cash flows just expresses the reality of cash flows in the facility and the degree of non -confirmation surrounding it, as well as the list of changes in the financial position just expresses the changes that have occurred in the property rights in the facility during a specific financial period (Cohen et al, 2014).

Theoretical relationship between research variables

The audit criteria did not specify any difference between the responsibilities of the auditor when searching for mistakes and fraud or his responsibilities for searching whether the distortion arose from misleading financial reports or the result of the embezzlement of assets in relation to both errors and fraud. Finance is free of fundamental distortion. The criteria also recognize that it is often difficult to discover fraud compared to errors, as the administration or its employees who make fraud try to hide that fraud, that the difficulty in discovering fraud will not change the responsibility of the auditor for planning and performing the audit process in a sound face, that One of the most important parts of the planning process is to assess the risk of errors and fraud (Kamran, 2013: 27). There is a major difference between the fraudulent financial report and the embezzlement of the assets, as the fraudulent financial report harms users by providing incorrect information contained in the financial statements that they make their decisions based on, but when the assets are embezzled (Alwan et al., 2023; Alyaseri et al., 2023; Salman et al., 2023), the shares, creditors and others may develop damage because the assets have not been Its ownership is available as the rights and assets of the company, and therefore both types of fraud are likely to lead to harm to users. The fading financial report is usually prepared by management, and sometimes without knowing the facility workers, as the administration in a position enables it to make decisions related to accountability and prepare reports without the knowledge and often its value is fundamental. One of the important things for the embezzlement of assets is the distinction between stealing assets and distortions arising from the theft of assets (Kaminski et al, 2014: 17: 17).Gathering accounting is one of the Lean methods used in the Lean approach, and it was adopted by the leading American and European companies, and it can be void if the auditor achieves positive results and a high degree of reliability in the financial and accounting statements by providing the statements that are characterized by the exported representation and lack of bias, and focus on the jewel of the information in addition To be careful in providing this information in an integrated manner. The task of auditor is to express an opinion on the financial statements of the facility (the financial center, the income statement, the cash flows and changes in property rights), and the opinion may be clean, conservative, unclean, or not being able to express an opinion. In order for the auditor to be able to form his opinion, he must carry out tasks and auditing procedures that help him reach the formation of the appropriate opinion. Among these methods is to examine the internal system, the control system, conduct fundamental tests, and submission tests. Therefore, these tasks can be strengthened by adopting the principles of Lean accounting of planning from the agility perspective and then transformation in practices and communicating information at the appropriate time as well as controlling the Lean accounting procedures and operations. To produce reliable financial data from the beneficiaries.

Methodology

The first hypothesis: There is a relationship between the auditor and the principles of lean accounting in the surveyed offices.

The second hypothesis: There is a relationship between the auditor and the reliability of the financial statements in the surveyed offices.

The third hypothesis: There is a relationship between lean accounting principles and the reliability of the financial statements in the surveyed offices.

The fourth hypothesis: There is an effect of lean accounting principles on the relationship between the auditor and the reliability of the financial statements in the surveyed offices.

Research methodology and tool

In this research, the researchers relied mainly on the analytical descriptive study method, which specializes in surveying the answers of individual researchers from observers in the auditors' offices in Iraq under study. The statistical programs (SPSS) and (Amos) were used, and the questionnaire was used as a basic tool in data collection search.

Search form

The systematic treatment of the research problem in the light of its theoretical framework and field implications requires the design of a hypothetical scheme. In building this scheme, the independent variables (accountant), intermediate (lean accounting principles), and approved (reliability of financial data) were adopted. Figure (1) shows the hypothetical research model.

Results

The first hypothesis: There is a relationship between the auditor and the principles of lean accounting in the surveyed offices.

To achieve this hypothesis, the researcher relied on a correlation coefficient (Pearson Correlation), and Table (1) shows the results of the correlations between compliance with the auditor's tasks and the principles of lean accounting.

| Variables | auditor | |

|---|---|---|

| lean accounting principles | Pearson Correlation | .669** |

| Sig. (2tailed) | .000 | |

| N | 208 | |

| Source: Prepared by the researcher | ||

The results of Table (1) indicate that there is a positively significant correlation between commitment to the tasks of the auditor and the principles of lean accounting, as the value of the correlation coefficient between them was (0.669**), and this value indicates the strength of the positive relationship between these two variables at a significant level (0.01) With a degree of confidence (99%).

Based on the foregoing, this relationship can be explained by the interest of auditors' offices in the study sample in the tasks of auditors that would support the application of lean accounting principles. In light of the above, the second main hypothesis can be accepted. This result is consistent with the study (Paterson, 2015), which showed that there is a positive correlation between compliance with the auditor's duties and the principles of lean accounting.

The second hypothesis: There is a relationship between the auditor and the reliability of the financial statements in the surveyed offices.

To achieve this hypothesis, the researcher relied on a correlation coefficient (Pearson Correlation), and Table (2) shows the results of the correlations between commitment to the auditor's duties and the reliability of the financial statements.

| Variables | Auditor | |

|---|---|---|

| reliability of the financial statements | Pearson Correlation | .638** |

| Sig. (2tailed) | .000 | |

| N | 208 | |

| Source: Prepared by the researcher | ||

The results of Table (2) indicate that there is a positively significant correlation between compliance with the auditor’s tasks and the reliability of the financial statements, as the value of the correlation coefficient between them was (0.638**), and this value indicates the strength of the direct relationship between these two variables at a significant level (0.01). With a degree of confidence (99%). Based on the foregoing, this relationship can be explained by the fact that the auditors’ offices, the study sample, seek to pay more attention to the auditor’s tasks in terms of importance, the greater the reliability of the financial statements. In light of the above, the first main hypothesis can be accepted. This result is consistent with the study of (Zinatul et al, 2015), which showed the existence of a positively significant correlation between the variable of commitment to the duties of the auditor and the variable of reliability of the financial statements.

The third hypothesis: There is a relationship between lean accounting principles and the reliability of the financial statements in the surveyed offices.

To achieve this hypothesis, the researcher relied on the Pearson Correlation, and Table (3) shows the results of the correlations between lean accounting principles and the reliability of the financial statements.

| Variables | lean accounting principles |

|

|---|---|---|

| reliability of the financial statements | Pearson Correlation | .869** |

| Sig. (2tailed) | .000 | |

| N | 208 | |

| Source: Prepared by the researcher | ||

The results of Table (3) indicate that there is a positively significant correlation between the principles of lean accounting and the reliability of the financial statements, as the value of the correlation coefficient between them was (0.869**). This value indicates the strength of the positive relationship between these two variables at a significant level (0.01) and with a degree Confidence (99%). Based on the foregoing, this relationship can be explained by the interest of the auditors’ offices, the study sample, in the principles of lean accounting through the principle of strengthening internal accounting control, the principle of delivering information in a timely manner, the principle of supporting the transition towards agility, and the principle of planning from the perspective of agility that would enhance the reliability of the data Finance. Considering the above, the third main hypothesis can be accepted. This result is consistent with the study (McCartney, 2014), which showed that there is a significant positive correlation between the principles of lean accounting and the reliability of financial statements.

The fourth hypothesis: There is an impact of lean accounting principles on the relationship between the auditor and the reliability of the financial statements in the surveyed offices.

That the test of significance of the variable (principles of lean accounting) and whether it has an effect on increasing the relationship between the variables of the study (commitment to the functions of the auditor and the reliability of the financial statements) or not. By testing the seventh hypothesis, which states (there is a significant effect of compliance with the auditor's duties in the reliability of the financial statements by the principles of lean accounting).

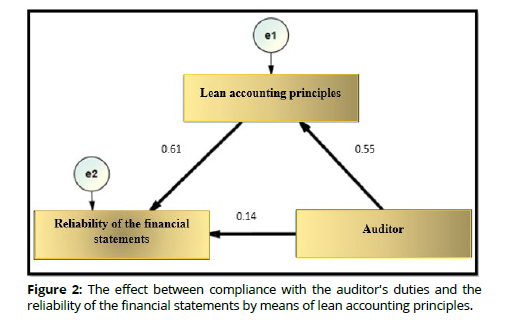

The clear results in Table (4) showed that there is an effect of the variable (lean accounting principles) on the relationship between the variables of the study (compliance with the functions of the auditor, reliability of the financial statements), as follows; It is clear from the results that the critical value CR between (to adhere to the auditor's tasks in the principles of lean accounting) amounted to (9.622), which is greater than the critical standard value of (1.82), and therefore there is a significant effect between (to adhere to the auditor's tasks in the principles of lean accounting). It is clear from the results that the critical value CR between (lean accounting principles in the reliability of financial statements) amounted to (10.207), which is greater than the critical standard value of (1.82), and therefore there is a significant effect between (lean accounting principles in the reliability of financial statements). Through the previous results, it is clear that there is a role for the variable (lean accounting principles) in affecting the relationship between (to adhere to the functions of the auditor and the reliability of the financial statements). with the auditor’s tasks in the reliability of the financial statements) amounting to (0.311), which is greater than the value of the direct effect between (to adhere to the auditor’s tasks in the reliability of the financial statements) and amounting to (0.191) and reliability of financial statements) is a partial effect (Figure 2).

| Variables | Indirect influence |

direct impact | S.E. | C.R. | P direct impact | Significance direct impact |

effect type | ||

|---|---|---|---|---|---|---|---|---|---|

| lean accounting principles | <--- | auditor | --- | 0.554 | 0.050 | 9.622 | *** | Moral | --- |

| reliability of financial statements | <--- | auditor | 0.311 | 0.138 | 0.053 | 3.019 | *** | Moral | partial effect |

| reliability of financial statements | <--- | lean accounting principles | --- | 0.612 | 0.057 | 10.207 | *** | Moral | --- |

| Source: Prepared by the researcher | |||||||||

Conclusion

The results of the current study showed the existence of a significant correlation between commitment to the tasks of the auditor and the reliability of the financial statements, which indicates the interest of the auditors’ offices, the study sample, in the variable of commitment to the tasks of the auditors, as these offices must work to improve the quality of financial reports by examining the effectiveness of The internal control system, ensuring the application of the laws and regulations regulating the company's work, following up the internal control operations, the extent of the management's commitment to the internal control system, and evaluating this system. The results of the current study showed the existence of a significant correlation between commitment to the tasks of the auditor and the principles of lean accounting, which indicates the interest of the auditors' offices in the study sample in the lean mentality that supports the lean control approach, which is a mentality that some internal auditors may find more difficult thinking, which is The viewpoint that stakeholders should regularly share with respect to what they value from the audit. The results of the current study showed the existence of a significant correlation between the principles of lean accounting and the reliability of financial statements. Agility and the principle of planning from an agile perspective would enhance the reliability of the financial statements. There is a partial effect of the mediating variable, lean accounting principles, between compliance with the functions of the auditor and the reliability of the financial statements, as the auditor's commitment to the principles of lean accounting enhances the reliability of the financial statements and showed that it is greater than the direct effect.

References

Abass, Z. K., Al-Abedi, T. K., & Flayyih, H. H. (2023). Integration Between Cobit And Coso For Internal Control And Its Reflection On Auditing Risk With Corporate Governance As The Mediating Variable. International Journal of Economics and Finance Studies, 15(2), 40–58. https://doi.org/10.34109/ijefs.202315203

Abass, Z. K., Flayyih, H. H., Salih, J. I., & Abdul Rahman, N. G. (2020). Conceptual Issues in Private information on Lean Accounting: Subject Review. Ishtar Journal of Economics and Business Studies, 1(1). http://www.ishtareconomics.org/

Abdullah, Z. I., Almsafir, M. K., & Al-Smadi, A. A, (2015), "Transparency and reliability in financial statement: Do they exist? Evidence form Malaysia", Open Journal of Accounting, 4(4), 29-43.

Adebayo, P.A., Adebiyi W.K., (2016), "Effect of firm characteristics on the timeliness of corporate financial reporting: evidence from Nigerian deposit money banks", International Journal of Economics, Commerce and Management, United Kingdom. 4(3).

Adediran, S. A., Alade, S. O., & Oshode, A. A. (2013), "Reliability of financial reporting and companies attribute: The Nigerian experience", Research Journal of Finance and Accounting, 4(16), 108-114.

Afolabi, F., (2017), "Financial reporting in Nigerian emerging market", Paper presented at a seminar organized by the Morgan State University, Victoria, August.

Ali, M. A., Hussin, N., Flayyih, H. H., Haddad, H., Al-Ramahi, N. M., Almubaydeen, T. H., Hussein, S. A., & Hasan Abunaila, A. S. (2023). A Multidimensional View of Intellectual Capital and Dynamic Innovative Performance. Journal of Risk and Financial Management, 16(3), 139.

Ali, S. I., Al-taie, B. F. K., & Flayyih, H. H. (2023). The effects of negative audit and audit environment on the internal auditor performance: mediating role of auditing process independence. International Journal of Economics and Finance Studies, 15(1), 64–79. https://doi.org/10.34109/ijefs.202315105

Alkhafaji, A., Talab, H. R., Flayyih, H. H., & Hussein, N. A. (2018). The Impact of Management Control Systems (MCS) on Organizations Performance a Literature Review. Journal of Economics and Administrative Sciences, 105(24), 1–16. https://www.iasj.net/iasj/article/146627

Al-Shammari, H. R. T. , Flayyih, H. H., & Al-Azzawi, Y. ,. (2017). The Role of Benford’s law to appreciation the risk in financial transactions Application study in Baghdad University. Journal of Accounting and Financial Studies, 12(41). https://doi.org/10.34093/jafs.v12i41.111

Al-Taee, S. H. H., & Flayyih, H. H. (2023). Impact of the electronic internal auditing based on it governance to reduce auditing risk. Corporate Governance and Organizational Behavior Review, 7(1), 94–100. https://doi.org/10.22495/cgobrv7i1p9

AL-Timemi, A. H., & Flayyih, H. H. (2013). Using Benford’s law to detecting earnings management Application on a sample of listed companies in the Iraqi market for securities. Journal of Economics and Administrative Sciences, 19(73). https://www.iasj.net/iasj/article/83413

Alwan, S. A., Jawad, K. K., Alyaseri, N. H. A., Subhi, K. A., Hussein, E. K., Aned, A. M., Sharaf, H. K., Flayyih, H. H., Salman, M. D., Abdulrasool, T. S., Abdulrasool, T. S., & Abed, R. A. (2023). The psychological effects of perfectionism on sport, economic and engineering students. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 18(3), 330–333. https://www.riped-online.com/archive/riped-volume-18-issue-3-year-2023.html

Alyaseri, N. H. A., Salman, M. D., Maseer, R. W., Hussein, E. K., Subhi, K. A., Alwan, S. A., zwaid, J. G., Aned, A. M., Jawad, K. K., Flayyih, H. H., Bachache, N. K., & Abed, R. A. (2023). Exploring the modeling of socio-technical systems in the fields of sport, engineering and economics. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 18(3), 338–341.

Baggaley, B. (2007). "Creating A New Framework for Performance Measurement of Lean Systems. Lean Accounting": Best Practices for Sustainable Integration, pp. 67-92.

Berger, P. G. (2011), "Challenges and opportunities in disclosure research—A discussion of the financial reporting environment: Review of the recent literature", Journal of Accounting and Economics, 51(1), 204-218.

Biddle, G. C., Hilary, G., & Verdi, R. S. (2009), "How does financial reporting quality relate to investment efficiency?", Journal of Accounting and Economics, 48(2-3), 112-131.

Blocher, Edward J; stout, David E; Cokins, Gary, (2010), "Cost Management a strategic emphasis", fifth edition, MC Graw – Hill Irwin, New York

Carolyn Windsor, Bent Warming-Rasmussen, (2009), ": The rise of regulatory capitalism and the decline of auditor independence: A critical and experimental examination of auditors’ conflicts of interests " Critical Perspectives on Accounting, Volume 20, Issue 2, Pages 267 - 288.

Cohen, J., Krishnamoorthy, G., & Wright, A. (2014), "The corporate governance mosaic and financial reporting quality", Journal of Accounting Literature, 23(1), 1-80.

Daniel Haskin, (2010), "Teaching Special Decisions in A Lean Accounting Environment", American Journal of Business Education –Volume 3, Number 6.

Daniel Haskin, (2010), "Teaching Special Decisions in A Lean Accounting Environment", American Journal of Business Education –Volume 3, Number 6.

Dogan, M., Coskun, E., Celik, O., (2017), "Is timing of financial reporting related to firm performance? – An examination of ISE listed companies", International Research Journal of Finance and Economics, 12: 220-233.

Ed. Stenzel, J. (2007). "Lean accounting: Best practices for sustainable integration". Wiley, New York NY, USA.

Efobi U., Okougbo P., (2014), "Timeliness of financial reporting in Nigeria", Research Gate, http://ssrn.com/abstract=2612371.

Flayyih, H. H. (2015). The Fraud under the fair value Exploratory St. Journal of Economics And Administrative Sciences, 21(86). https://www.iasj.net/iasj/article/107929

Flayyih, H. H. (2016). The role of open budget in achieving of the transparency and responsibility and reflect it on the administrative and financial corruption. journal of Economics And Administrative Sciences, 22 (90). https://www.iasj.net/iasj/article/111457

Flayyih, H. H., & Khiari, W. (2023). Empirically Measuring the Impact of Corporate Social Responsibility on Earnings Management in Listed Banks of the Iraqi Stock Exchange: The Mediating Role of Corporate Governance. Industrial Engineering and Management Systems, 22(3), 321–333. https://doi.org/10.7232/iems.2023.22.3.321

Garrison, R., Noreen, E., Brewer, P. (2010),"Managerial Accounting", 13Th Edition, McGraw Hill, Irwin.

Gillan, John D. Martin Stuart L. (2007), :”Corporate governance post-Enron: Effective reforms, or closing the stable door?” Journal of Corporate Finance, Volume 13, Issue 5 , December, Pages 929 - 958 .

Hadi, A. H., Abdulhameed, G. R., Malik, Y. S., & Flayyih, H. H. (2023). The influence of information technology (it) on firm profitability and stock returns. Eastern-European Journal of Enterprise Technologies, 4(13(124)), 87–93. https://doi.org/10.15587/1729-4061.2023.286212

Hadi, A. H., Ali, M. N., Al-shiblawi, G. A. K., Flayyih, H. H., & Talab, H. R. (2023). The effects of information technology adoption on the financial reporting: moderating role of audit risk. International Journal of Economics and Finance Studies, 15(1), 47–63. https://doi.org/10.34109/ijefs.202315104

Hansen, Don R; mowen, Maryanne M, (2009), "Managerial Accounting", eight editions, Thomson, South – Western, united states of America.

Hasan, S. I., Saeed, H. S., Al-Abedi, T. K., & Flayyih, H. H. (2023). The role of target cost management approach in reducing costs for the achievement of competitive advantage as a mediator: an applied study of the Iraqi electrical industry. International Journal of Economics and Finance Studies, 15(2), 214–230. https://doi.org/10.34109/ijefs.202315211

International Accounting Standards Board ( IASB), (2018), "Exposure draft on an improved conceptual framework for financial reporting: the objective of financial reporting and qualitative characteristics of decision-useful financial reporting information", The European Accounting Review, 1(1), 45-68.

Iyoha, F.O., (2012), "Company attributes and the timeliness of financial reporting in Nigeria", Business Intelligence Journal, Vol. 5(1), 41- 49.

John E. McEnroe, (2019), “CFOs’ and public accountants’ perceptions of material weaknesses in internal control areas as required by Section 404 of the Sarbanes-Oxleyact , Regulation, Volume, Pages 63-67.

Kaminski, K.A., Wetzel, T.S. and Guan, L. (2014) "Can Financial Ratios Detect Fraudulent Financial Reporting?", Managerial Auditing Journal, 19, 15-28.

Kaminski, K.A., Wetzel, T.S. and Guan, L. (2014) "Can Financial Ratios Detect Fraudulent Financial Reporting?", Managerial Auditing Journal, 19, 15-28.

Kamran, A, (2013), "The timeliness of corporate reporting: A comparative study of South Asia", Advances in International Accounting, Volume 16: 17–43.

Kamran, A, (2013), "The timeliness of corporate reporting: A comparative study of South Asia", Advances in International Accounting, Volume 16: 17–43.

Kateryna Ogar, Muhammad Abdus Samad, Yumeng Shu, (2017), "Value Creation with Lean Accounting -optimizing utilization of resources through the value chain applying management accounting techniques in a package around management control system", Master Program in Accounting and Finance, Accounting and Management Control, BUSN79 Degree Project, Spring.

Kateryna Ogar, Muhammad Abdus Samad, Yumeng Shu, (2017),"Value Creation with Lean Accounting -optimizing utilization of resources through the value chain applying management accounting techniques in a package around management control system", Master Program in Accounting and Finance, Accounting and Management Control, BUSN79 Degree Project, Spring.

Liou, F.-M. (2018), "Fraudulent Financial Reporting Detection and Business Failure Prediction Models: A Comparison", Managerial Auditing Journal, 23, 650-662.

Maseer, R. W., Zghair, N. G., & Flayyih, H. H. (2022). Relationship between cost reduction and reevaluating customers’ desires: the mediating role of sustainable development. International Journal of Economics and Finance Studies, 14(4), 330–344. https://doi.org/10.34109/ijefs.20220116

Maskell, B. H, & Baggaley, B. L. (2006)."Principles, Practices, and Tools of lean accounting: Lean accounting summit". Association for Manufacturing Excellence’s Target Magazine.

Maskell, B. H, & Baggaley, B. L. (2006)."Principles, Practices, and Tools of lean accounting: Lean accounting summit". Association for Manufacturing Excellence’s Target Magazine.

Monroy, Carlos and Nasiri, Azadeh and Pelaez, Miguel, (2013), "ABC, Td ABC, Lean accounting: Accounting Systems Approach to Manufacturing", Management Accounting Journal, Vol. 24, No. 5.

Nikkeh, N. S., Hasan, S. I., Saeed, H. S., & Flayyih, H. H. (2022). The role of costing techniques in reduction of cost and achieving competitive advantage in iraqi financial institutions. International Journal of Economics and Finance Studies, 14(4), 62–79. https://doi.org/10.34109/ijefs.20220104

Philip M.J. Reckers, Dahlia Robinson, (2007), “New Evidence on Auditor Independence Policy” Advances in Accounting, Volume 23 , Pages 207 - 229.

Salman, M. D., Alwan, S. A., Alyaseri, N. H. A., Subhi, K. A., Hussein, E. K., Sharaf, H. K., Bachache, N. K., Jawad, K. K., Flayyih, H. H., Abed, R. A., zwaid, J. G., & Abdulrasool, T. S. (2023). The impact of engineering anxiety on students: a comprehensive study in the fields of sport, economics, and teaching methods. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 18(3), 326–329. https://www.riped-online.com/archive/riped-volume-18-issue-3-year-2023.html

Tontiset Nattawut, Kaiwinit Sirilak, (2018), "The Factors Affecting Financial Reporting Reliability: An Empirical Research of Public Listed Companies in Thailand", Journal of Modern Accounting and Auditing, Vol. 14, No. 6, 291-304

Vrentzou, E, (2017), "The Effects of International Financial Reporting Standards on the Notes of Auditors", Managerial Finance, 37, 334-346.

Wempe, William F, (2011), "Financial Consequences from Implementing Lean Manufacturing with the Support of Non-Financial Management Accounting Practices", Management Accounting Section (MAS) of American Accounting Association (AAA) conference.